The nanometre race: what is the state of the Russian semiconductor industry?

Serhii Volkov

This article continues the series of articles entitled ‘The nanometre race’. Today, we will look at the development of semiconductors in Russia and how this affects (or does not affect) the world.

This article continues the series of articles entitled ‘The nanometre race’. Today, we will look at the development of semiconductors in Russia and how this affects (or does not affect) the world.

DISCLAIMER: Unfortunately, the author does not have access to documentation on Russian semiconductor technologies, so this article is based solely on data from open sources with critical analysis of specific parameters.

RF inherited semiconductor technologies and factories from the Soviet Union. Semiconductor technologies and specific solutions (such as programmable integrated circuits with UV - erasing) were mostly copied from Western systems and models. Over the years of its existence as an independent country, the Russian Federation has not developed an effective economic model for the production of semiconductor products and has let the system for training specialists collapse. Soviet semiconductors proved to be uncompetitive with Western ones, so the technologies existing in the RF are used exclusively when budget funding is available for scientific research, space and military spheres.

Currently, it is clear that Russia obtains samples of Western semiconductor systems through third countries or Chinese devices for use in combat zones and for civilian users. However, we are interested in whether the RF's own industry can offer anything as an import substitute.

Problems of the Russian semiconductor sector

If we take a closer look at the condition of the Russian semiconductor sector in the 21st century, it becomes clear that it is on a path of degradation rather than development. The Russian semiconductor technology sector was financed on the principle of a research institution, where no real results are required, only a report on the work done. The vast majority of the sector's results were not commercialised due to the lack of competitive products. The closed nature of the financing of military-industrial complex projects, implemented jointly with the semiconductor industry, did not contribute to transparency and efficiency in the use of funds. Meanwhile, for a long period of time, budget allocations were not even sufficient to maintain the existing infrastructure and retain key specialists. As a result, a number of leading manufacturers (NM-Tech) stopped production or went bankrupt (Angstrem). The situation was no better at Micron Group or ZNTC.

All this did not contribute to the gradual development and emulation of experience, which is very important in this field. The motivation of specialists declined, and professionals either left the country or moved to the information technology sector, for example. As of 2013, the Russian semiconductor sector was in a depressing state, when even budget allocations were insufficient to retain specialists. The sector as a whole increasingly resembled an old and inefficient academy of sciences, which was maintained solely by Soviet-era personnel, whose numbers were diminishing. From discussions with Russian colleagues back in 2013, it was clear to the author that the industry was reported to be in a state of despair, passiveness and realising the hopelessness of this field in the RF, both for specialists and for the market, due to a lack of funding and the lack of value of the products themselves. Things began to change somewhat in 2014, when a course of import substitution was announced, but the inefficient system could not change quickly.

How Russians can substitute the import semiconductor chips

The most productive enterprises in the semiconductor industry are located near Moscow in the city of Zelenograd. Angstrom, Zelenograd

Angstrom, Zelenograd

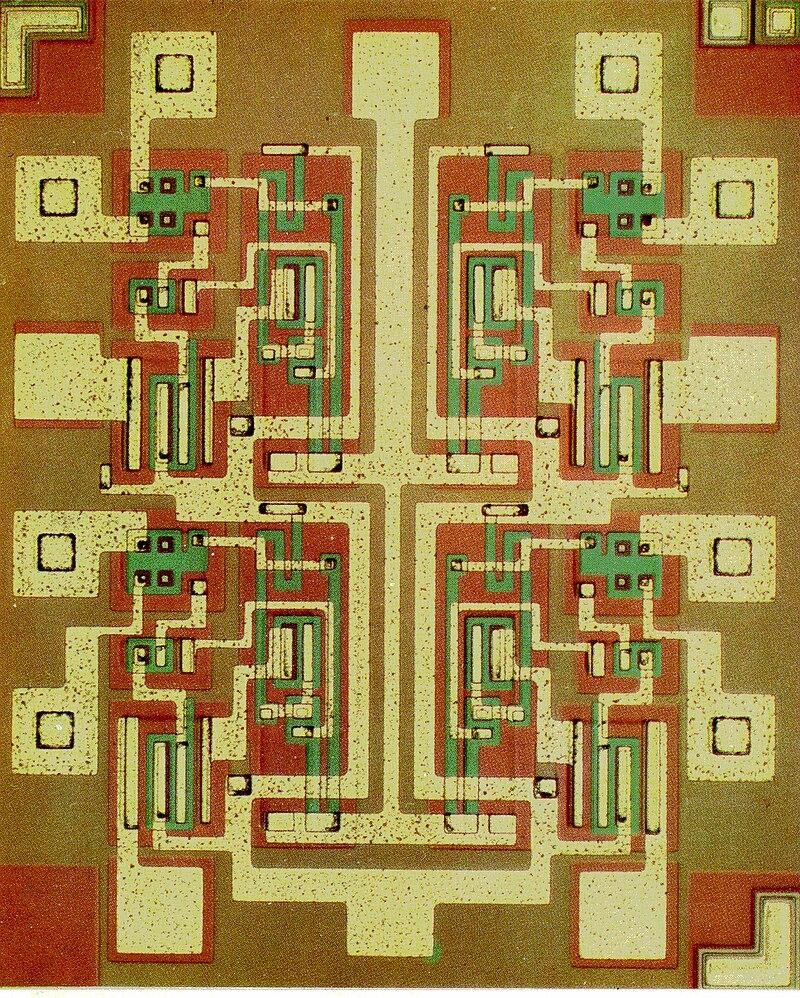

They have 350 nm and 180 nm technologies available to them. 180 nm technology

180 nm technology

Let's take a closer look at what can be created using 180 and 350 nm technologies that are commercially available to Russians.

The 180 nm technology was commercialised by leading players in the semiconductor market (TSMC, Fujitsu, Sony, Toshiba, AMD, etc.) in 1999. The 350 nm technology was commercialised even earlier, in 1993. This means that the latest Russian semiconductor technology is 26 years old. In the world of semiconductors, this is a very long time, but many devices do not require the best technological achievements and can be created on the basis of outdated processes. In principle, such technologies allow the design of command controllers, including transport, industrial and military ones. It is possible to create various types of digital equipment from 2000 to 2005 (including user equipment) and power devices.

Since we do not know the specific parameters of the Russian technical process, the author will take the liberty of considering what can be created using Western technologies, such as IBM 180 nm. This technology can cover the transport sector (except for aviation), industrial automation, some communication systems (up to the level of 2005-2008) and the military sector (if high-performance computing is not required, such as in encryption and artificial intelligence).

Does this mean that Russians can do the same thing using existing processes?

Probably not, but this area is very important for the operation of the Russian military-industrial complex, confirmed by the interest of the Ukrainian militaries (and UAV strikes) in the production of Kremny EL in Bryansk.

Kremny EL

Kremny EL

The RF's attempts to invest in semiconductor systems are unlikely to change the existing dependence on Western and Chinese technologies here and now.

Russia's dependence on China

Russia's dependence on China

On the development side, there is a problem with the quality and quantity of developers, their motivation and process structure. Developers, from their side, may not limit themselves exclusively to Russian technologies and focus on available Chinese ones. However, this would create a threat from China to the intellectual property of the latest Russian developments, and in the author's opinion, the Russians will try to avoid this option as much as possible (if we are talking specifically about the military-industrial complex).

Conclusion

Let's try to formulate the summary. Technologically, the Russian Federation can produce semiconductors for a specific narrow segment, such as "the military sphere 1", or industry, or transport, but the quantity and quality of its own products are not sufficient at all. To meet current needs, imports through third countries and imports from China are used. However, the RF is investing heavily in the semiconductor industry and actively recruiting, which indicates an understanding of its vulnerabilities due to technological lag and an attempt to reduce it, at least in the military sphere.

Semiconductors, even those produced using relatively old technologies available in Russia, can be used in weapons and ammunition to kill people. The Russians are unlikely to completely overcome their lag, but they will be able to bring some of their own technological products to the battlefield in Ukraine, which will not be a pleasant surprise for the Armed Forces of Ukraine and may even lead to crises on the battlefield. Therefore, the semiconductor industry in Russia must be taken as seriously as possible, and we must not allow ourselves to be arrogant or to have "tomorrow-is-victory" feeling.

1 — The author deliberately does not go into more detail about the sphere of applications, as this requires a more comprehensive analysis.