INFORMATION AND ANALYTICAL

COMMUNITY

+ Join

Support

RESURGAM EDITORIAL

While Russia's war against Ukraine is still far from over, military tensions are rising on several continents, and everyone is mentally preparing for World War III, the world is experiencing a huge shortage of gunpowder. Without gunpowder, there will be no shells for howitzers, no cartridges for automatic weapons, and therefore no victory in wars.

While Russia's war against Ukraine is still far from over, military tensions are rising on several continents, and everyone is mentally preparing for World War III, the world is experiencing a huge shortage of gunpowder. Without gunpowder, there will be no shells for howitzers, no cartridges for automatic weapons, and therefore no victory in wars.

Gunpowder production does not begin at a gunpowder factory. It begins in the fields, where the necessary raw material is grown under the open sky – cotton plant, from which the cotton material is obtained.

Cotton fibre is 95% cellulose, which must be converted into nitrocellulose. After mixing with other substances, nitrocellulose is converted into smokeless gunpowder, which ultimately becomes the most deficient component for ammunition.

The ability to provide oneself with strategic raw materials and not depend on unreliable geopolitical players is becoming a political mainstream throughout the world.

Ukraine understands this better than anyone else. For the second year in a row, our country has been experimenting with growing its own cotton aimed at powder production chains. How successful has this been?

This article is based on video material from the international analytical community Resurgam.

In the 1930s, there were attempts to grow cotton on an industrial scale in southern Ukraine. However, this experiment was unsuccessful due to the unfavourable climate and low yields.

Nevertheless, in May 2024, cotton cultivation was restarted. The government of independent Ukraine launched an experimental project in the south of the country. Has the climate become more favourable? Yes.

Today, climatic conditions are changing very rapidly. And if we talk specifically about our country, the climate zone has shifted by almost 100 kilometres. Today, the Odessa region has the same climate that Crimea used to have, for example. And climate change is actually positive for cotton cultivation, explains Alla Stoyanova, head of the "Odessa Agrarians" NGO.

Climate change is particularly noticeable in the southern regions – Kherson, Mykolaiv and especially the southern part of the Odesa region in the Danube region. This makes cotton a relevant crop for Ukrainian farmers in these regions. Cotton cultivation area in the Odesa region

Cotton cultivation area in the Odesa region

Cotton is a demanding crop: it requires agronomic precision, a favourable climate and a willingness to play the long game. This is not only an opportunity, but also a risk. Because war is nearby. Irrigation has been destroyed. Markets are only just forming.

Now, we are at the starting point: testing varieties, adapting technologies, looking for specialised equipment, studying the requirements for temperature, moisture and soil. There are many challenges ahead.

Last year, we conducted tests on five strains. This year, we are testing six strains. After the first year, we concluded that cotton can produce a harvest. Different strains, with different cultivation methods and different combinations showed: last year's climate potentially made it possible to harvest 1.5 to 3 tonnes of raw cotton per hectare, depending on the strain, says Serhiy Melnyk, director of the Ukrainian Institute for Plant Variety Examination.

According to Melnyk, this cotton yield is the optimal norm, as it can be grown in the Ukrainian climate.

‘Of course, one year is not representative; testing must be carried out for at least three years, or better, five years. Then there are even fewer risks. But we don't have that much time to waste.’

Unripe cotton

Unripe cotton

When we talk about any crop, whether it is cotton, vegetables, or berries, we need to look at the entire chain from the producer to the end consumer. In other words, we need to understand "where this crop and this product will be used. Is there any domestic demand and a domestic market for it, or is there an opportunity to export it?” notes Trofimtseva.

Serhiy Melnyk is convinced that if cotton becomes economically profitable, everyone will start growing it.

Twenty years ago, no one wanted to grow rapeseed. But when demand for it grew, as for high-temperature oil, biodiesel, meal, and other things, the market immediately took off and everyone started growing this crop.

He recalls that previously, a maximum of one tonne of rapeseed could be obtained from one hectare, whereas now — up to four tonnes.

Cotton cultivation is a certain risk that farmers take into account because they are working with an exotic crop.

Farmers should not be alone in this process. For a new crop to take root, comprehensive support programmes are needed and, most importantly, an understanding of where to sell this raw material. Farmers should not be left alone in this process. For a new crop to take root, comprehensive support programmes are needed, and most importantly, an understanding of where to sell this raw material. Without established markets and processing, it will remain at the experimental stage.

This year, about 20 enterprises expressed their desire to sow and grow cotton. But we will see in a few weeks how many of them succeeded. Today, farmers who have the opportunity to sow cotton can also receive compensation from the state in the amount of 10,000 UAH per hectare, which is approximately half of the costs.

This year, unfortunately, we were a little late in adopting state aid, but it was adopted. That was on 29 April, and today farmers who are able to sow can receive about 10,000 hryvnias per hectare. This is compensation from the state.

Next year, we will definitely defend the support of those agricultural producers who will grow cotton. And I think we will keep that support at 10,000 hryvnias per hectare, said member of parliament Stepan Chernyavsky, who is one of the active supporters of this idea in parliament.

One of the main problems in the mass cultivation of cotton is the lack of specialised combine harvesters. The cost of such used combine harvester is about 250,000 dollars.

Specialised combine harvester for harvesting cotton. Source: TRADEFarmMachinery

Specialised combine harvester for harvesting cotton. Source: TRADEFarmMachinery

This year, three hectares can also be harvested by hand. This will not be a problem. But next year, if we move to industrial areas, we will need specialised equipment – specific harvesters for harvesting cotton.

Today, we are in talks with companies and manufacturers that produce such equipment. For example, I spoke with representatives of John Deere. They have such harvesters, we have already looked at them, and they will suit our needs. They said that if we move to an industrial level, they will be ready to supply us, says Stoyanova.

It is clear that Ukrainian cotton can find its market in Ukraine. But then it will be necessary to formulate an appropriate policy in the agro-industrial sphere, which will concern not only cotton cultivation. This is to avoid a situation where, for example, 30,000 hectares of cotton are grown, but there are problems with sales due to unresolved issues, such as the use of this cotton for military purposes or even its processing.

According to Stepan Chernyavsky, Ukraine's defence sector needs 10,000 tonnes of cellulose per year to make gunpowder. To meet this demand, cotton needs to be planted on an area of about 30,000 hectares.

At the first stage, we plan to reach approximately 20,000 hectares next year. These are our calculations. Primary processing will already begin. I think that the actual production of gunpowder will be carried out by our European partners. But primary processing will be done here in Ukraine, said Stepan Chernyavsky.

Harvested cotton crop

Harvested cotton crop

For us, I believe that the European Union market is the most important, says Trofimtseva.

It is important to understand that when processing capacities are created in Ukraine, production and all the latest technologies will be concentrated in Ukraine, because everything will be done from scratch.

The latest equipment and technologies will improve the quality, cost and supply of Ukrainian production to other markets.

Alla Stoyanova notes that Ukraine will require 20,000 hectares of land to meet its needs.

If we include neighbouring regions: Mykolaiv, Kherson, Zaporizhia and even Vinnytsia, we can provide for ourselves and Europe.

What is normal for us – production without forced or child labour – is increasingly becoming an advantage on the international market. While some cotton products from authoritarian countries are subject to restrictions, Ukraine can offer an ethical and transparent alternative.

But this opportunity is not permanent. It is necessary not only to develop production, but also to closely monitor the markets. Even countries that declare their commitment to human rights sometimes turn a blind eye to the origin of raw materials. This is where diplomacy plays an important role — to convey that Ukrainian cotton meets not only quality standards but also principles of integrity.

Ruslan Miatiev, editor of Turkmen.news, notes:

The big problem with Turkmen cotton is that it is most often harvested using coercion. This is a practice from Soviet times, when civil servants of various levels were sent to pick cotton from the end of August to mid-December. This practice still exists today, with the only difference being that schoolchildren are no longer forced to do it, but budgetary employees are sent instead.

Over the past ten years, people in Turkmenistan have been given the option of either going to pick cotton themselves or paying money for a hired worker. “This is also considered forced labour. In other words, people are forced to pay for someone else’s work from their own pockets,” he noted.

School teachers and kindergarten teachers bring cotton to be weighed, Turkmenistan, 2022. Photo: Turkmen.News

School teachers and kindergarten teachers bring cotton to be weighed, Turkmenistan, 2022. Photo: Turkmen.News

Today, more than 140 global brands, including Nike, Adidas and other major brands, have publicly refused to work with Turkmenistan. This means that if they know that the raw materials come from this country, they will not work with this supplier. This means that Turkmenistan currently has very few opportunities to sell its textile products or raw cotton, Miatiev notes.

A fierce battle is raging on global markets. Cotton is a strategic raw material for both the defence and light industries.

The Financial Times wrote that leading arms manufacturers, including Sweden's Saab and Germany's Rheinmetall, have warned that Europe is overly dependent on cotton fibre from China, which accounts for just under half of global trade. The largest importers of the material are Germany, Sweden and Belgium.

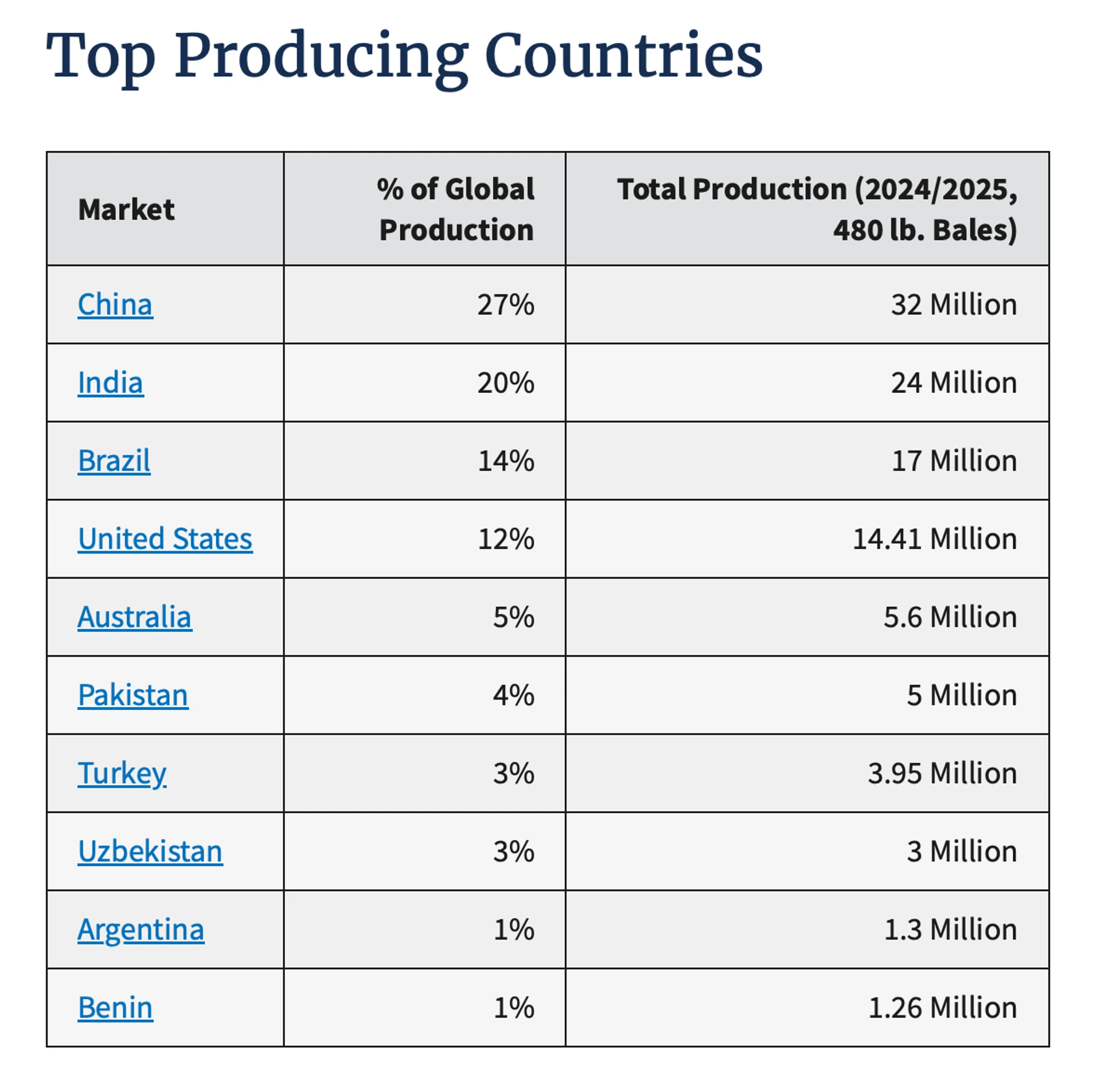

According to the USDA Foreign Agricultural Service, in the 2024/2025 agricultural marketing year, global cotton production was 119.9 million bales (statistics traditionally define the weight of a bale of cotton as 480 pounds, which is approximately 218 kg).

China is the leader, producing 32 million bales of cotton, which accounts for 27% of global cotton production. India is in the second place with 24 million bales (20%).

Next are: Brazil with 17 million (14%), The United States with 14.4 million (12%), Australia with 5.6 million (5%), Pakistan with 5 million (4%), Turkey – 3.95 million (3%), Uzbekistan – 3 million (3%), Argentina – 1.3 million (1%), Benin – 1.26 million (1%).

The European Union ranks 11th with a production of 1.24 million cotton bales (1% of world production).

Leading cotton-producing countries in the world in 2024/2025 (in 480-pound bales, 480 lb. Bales). Source: USDA Foreign Agricultural Service

Leading cotton-producing countries in the world in 2024/2025 (in 480-pound bales, 480 lb. Bales). Source: USDA Foreign Agricultural Service

If we look at the structure of the EU cotton market today, 45% of cotton on the EU market is supplied from the European Union countries themselves. These are primarily Greece, Spain and Bulgaria. In other words, southern Europe already grows cotton. However, 55% of this demand in the European Union market is covered by imports from third countries, and these suppliers are Asian countries. But first and foremost, Turkey accounts for the largest share of cotton supplies to the European Union, explains Olga Trofimtseva.

Ukrainian cotton could contribute to European security. It is important to consistently demonstrate and discuss at a diplomatic level that issues of collective security, and the reliability of supplies of strategic raw materials necessary for defence, are at stake.

RESURGAM EDITORIAL

You may be interested