INFORMATION AND ANALYTICAL

COMMUNITY

+ Join

Support

Sergii Rybalka, intern at the think tank Resurgam

Photo: Getty Images

Photo: Getty Images

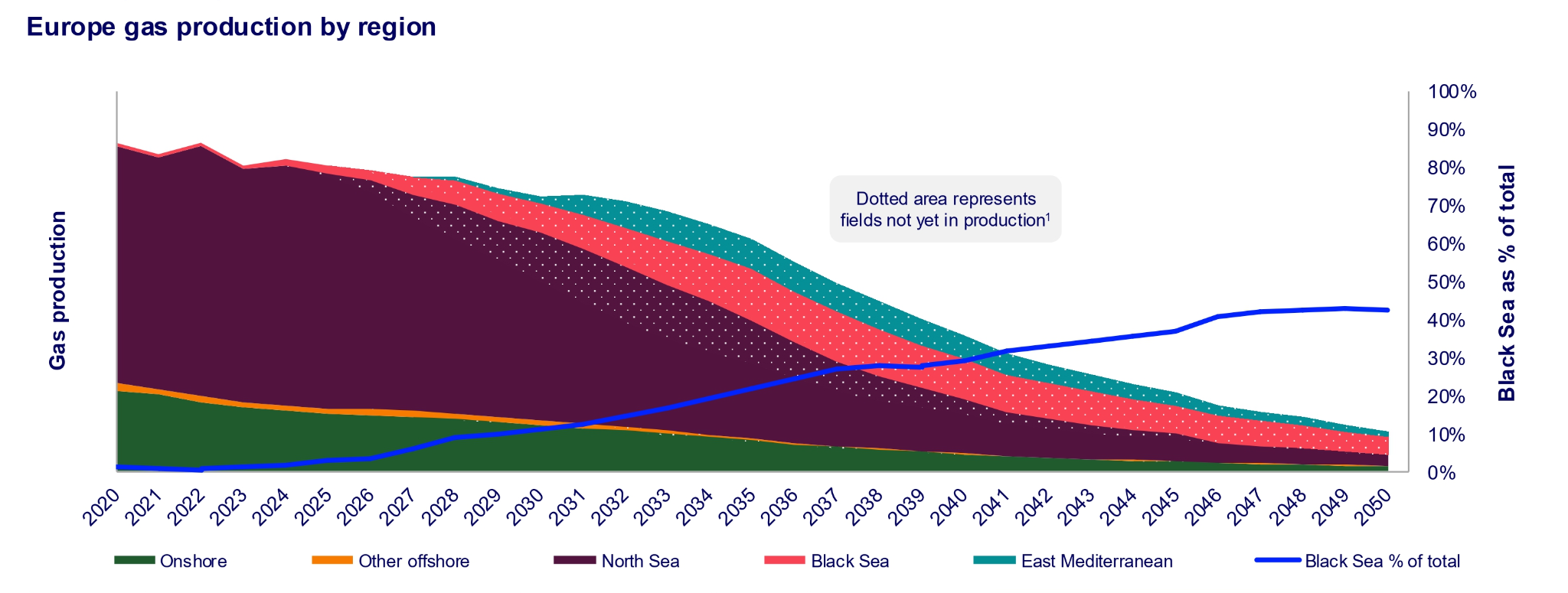

The Black Sea accounts for 4 out of 10 largest gas field launches in Europe over the next decade. It is in Ukraine's interests to join this list. However, Ukraine is at war and cannot invest in the sea as quickly. So there is a question: will there be a place for us in the new energy architecture after the war, and does the path to energy independence really lie underwater? The Black Sea in the structure of new European gas production. Source: Wood Mackenzie

The Black Sea in the structure of new European gas production. Source: Wood Mackenzie

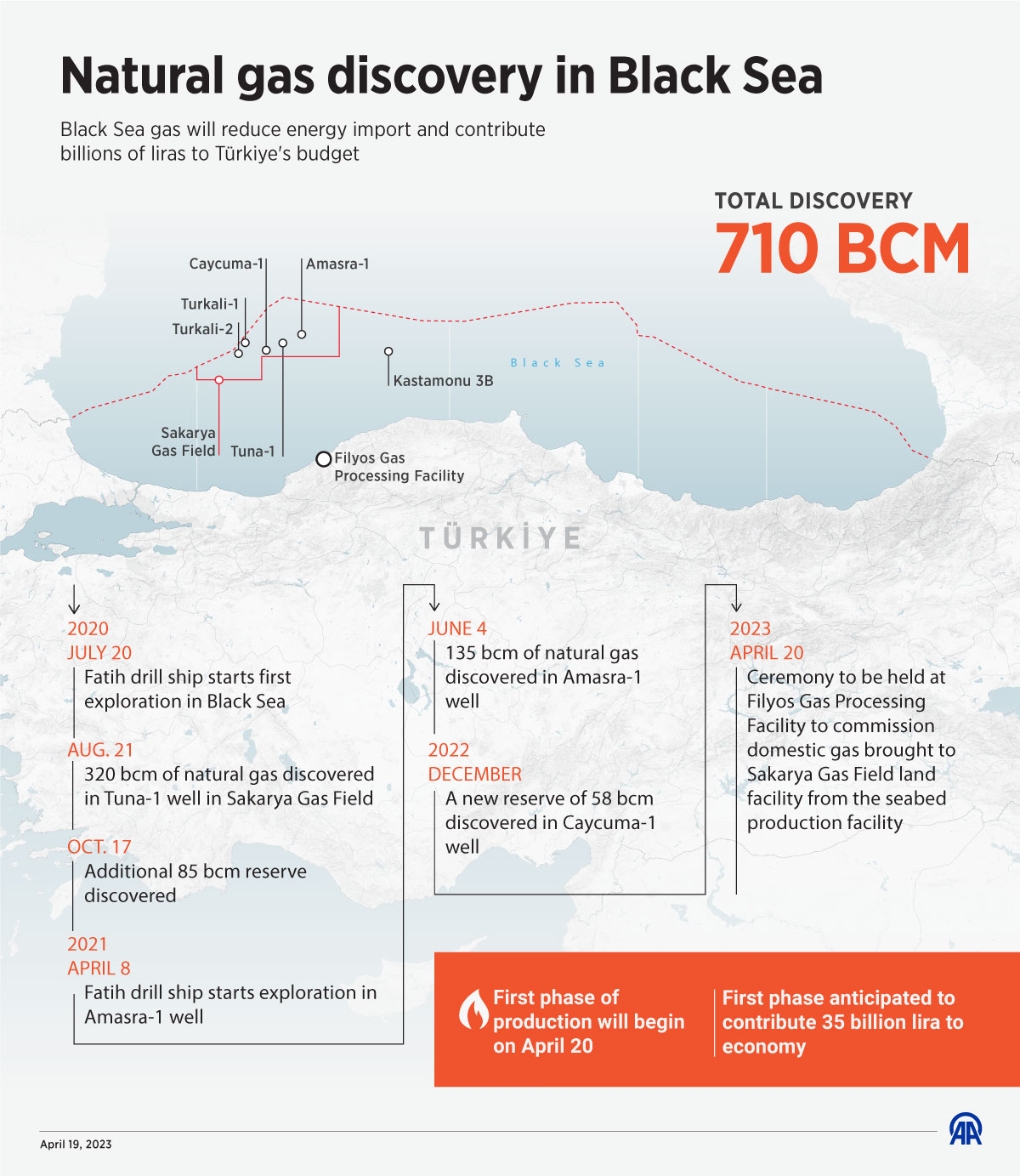

2020 became a turning point for Black Sea energetics: after the discovery of the Sakarya field in Turkish waters, 710 billion cubic metres were found. This changed the balance and showed that the Black Sea is self-sufficient, not just an annex to Russian pipelines.

Since then, the Turkish shelf has become a magnet for capital and technology. Even after adjusting engineering solutions and logistics, the project of conquering deep-water deposits passed a budget review, keeping its market attractiveness. Analysts classify the Turkish shelf as ‘advantaged gas’ for Europe, i.e. with competitive costs and an acceptable carbon footprint. Supplies are already underway – the Turkish government has announced that it will reach ~40 million m³/day in 2026-2028, which could cover about a third of the country's demand.

Turkey is transitioning from a transit country to a regional leader that sets the rules of the game. Leveraging the synergy of offshore production and onshore infrastructure, Turkey is setting a faster pace than its neighbours. Several liquefied natural gas (LNG) terminals with access for private shippers (transportation service customers), expanded underground gas storages (UGS), network interconnections and exchange infrastructure. All this has made possible agreements to supply Moldova, Romania and Hungary, along with a 13-year agreement with Bulgaria as part of its energy diversification efforts, and the launch of an open ‘Black Sea Mine Action Task Force’. Chronology of natural gas exploration in Turkish waters. Source: Anadolu Agency

Chronology of natural gas exploration in Turkish waters. Source: Anadolu Agency

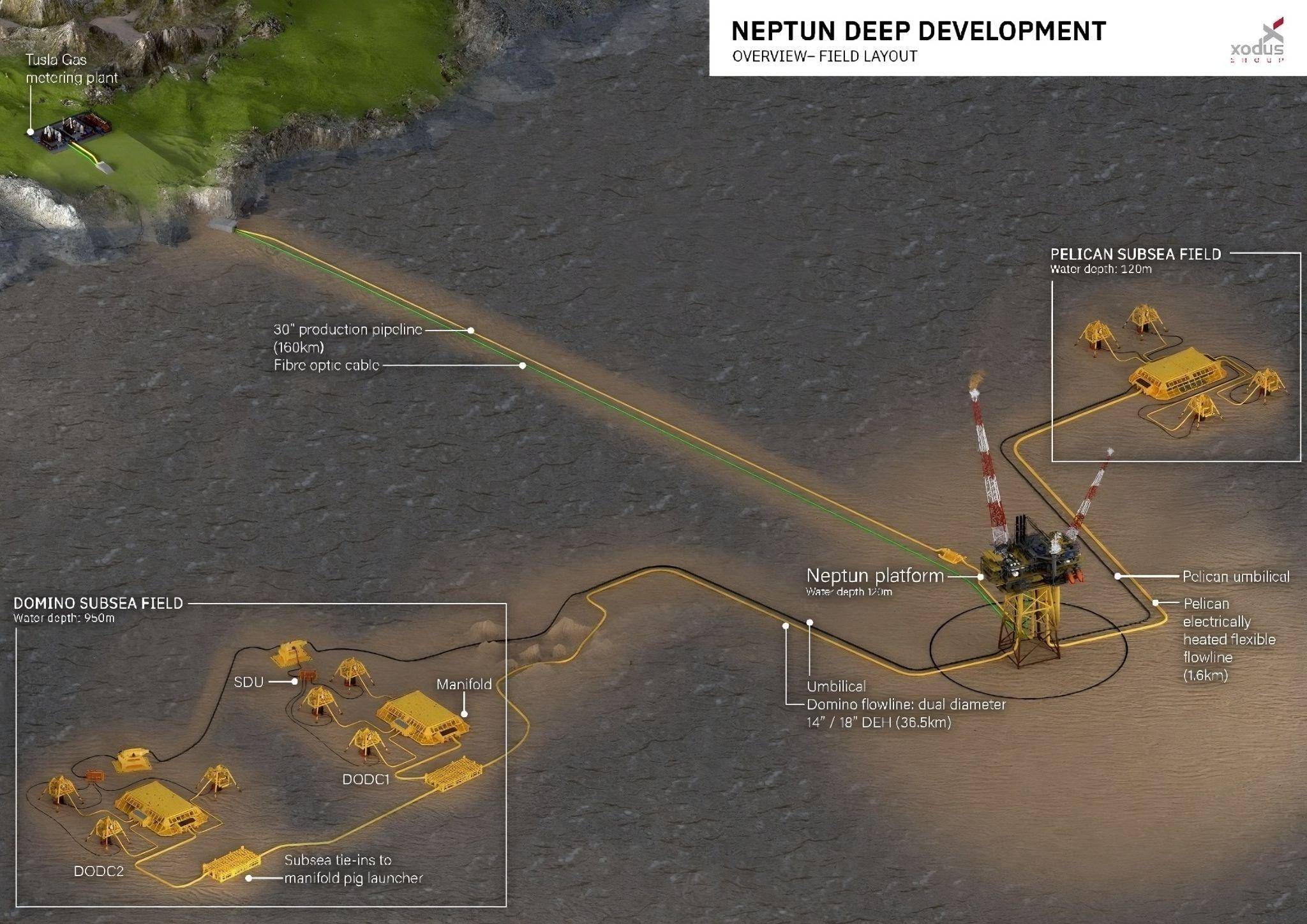

The Romanian megaproject Neptun Deep, the EU's largest green gas start-up, aims to become a game changer for the entire basin. Investment decisions have already been made. The goal - to start producing gas in 2027, reaching a plateau of about 8 billion cubic metres per year and a resource base of about 100 billion cubic metres. Gas from the shelf will be transported via the new Tuzla–Podișor pipeline (308 km), connecting the sea with the BRUA corridor (Bulgaria–Romania–Hungary–Austria) and further on to the markets of Central Europe.

The plan is simple and ambitious: Romania will overcome its domestic deficit and regain its glory as a pioneer of the European gas industry with the status of a net exporter. Starting in 2027, Romania will meet the demand of Moldova, Bulgaria and Serbia, marking the country's role in the history of the formation of the Black Sea energy hub. Schematic diagram of Neptun Deep's connection to Romania's energy system. Source: Vienna Project Academy

Schematic diagram of Neptun Deep's connection to Romania's energy system. Source: Vienna Project Academy

On the gas front, Bulgaria is working on three tracks.

The first is high-risk but potentially rich deep-water areas. In 2023-2024, exploration of block 1-21 Khan Asparuh (an area designated by the state for geological exploration and production) was resumed. Drilling of the Vinekh and Krum wells is expected to begin in the fourth quarter of 2025.

The second is corporate farm-in agreements (where a partner buys a stake in the licence and finances the work). 1-26 Han Tervel - currently the only active block.

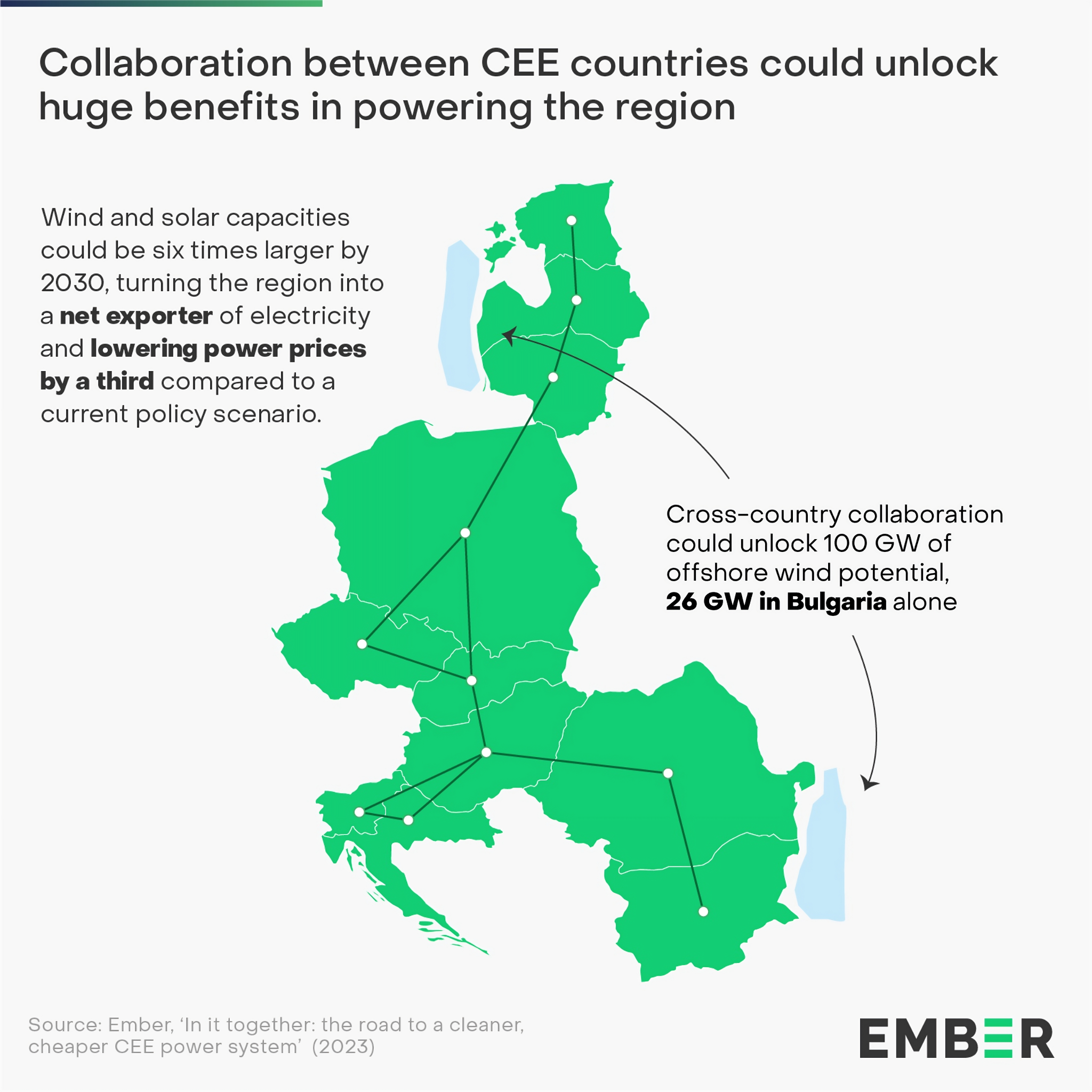

The third is offshore wind energy as part of a programme to end Europe's dependence on fossil fuels. The potential estimates are great, but the launch requires legal infrastructure, the identification of zones, ports and shipyards, network power delivery points on the coast, and most importantly, a support mechanism (auctions and/or contracts for price differences).

In 2025, the EU placed the Black Sea in a separate political strategy: the vision - ‘a secure, interconnected and prosperous space’. Under the umbrella of Global Gateway, security, energy, transport and green transformation have been brought together to make the Black Sea an integral part of the single market – from gas to electricity.

This involves strengthening east-west and south-north interconnectivity, restoring supply chains, reducing dependence on Russian energy sources, and developing own resources/infrastructure. There is also a focus on demining, critical infrastructure protection and cable security – practical conditions without which working at sea in these turbulent times is simply impossible.

In parallel with the expansion of the Southern Gas Corridor, the EU supports the Vertical Corridor (Greece – Bulgaria – Romania – Hungary – Slovakia – Moldova – Ukraine) to bring gas from the South/East to Central Europe. The goal is simple: to increase energy security and reduce import dependency in the spirit of REPowerEU.

The EU is also preparing an underwater high-voltage interconnector between Romania and Georgia – Black Sea Submarine Cable (BSSC) – a project that creates a new “axis” for green electricity and strengthens the resilience of systems. The line will connect Georgia and Romania, creating a corridor for the export of renewable energy from the South Caucasus to Europe. An offshore wind strategy is being rolled out in parallel at sea: the EU is targeting 60 GW by 2030 and 300 GW by 2050, and the Black Sea is among the top five basins with the greatest potential. BSSC route map. Source: Georgian State Electrosystem

BSSC route map. Source: Georgian State Electrosystem

For Ukraine, the key factors are the direct link between regional stability and our security, the course towards market integration, and the EU's direct interest in Black Sea projects with potential support from the European Investment Bank.

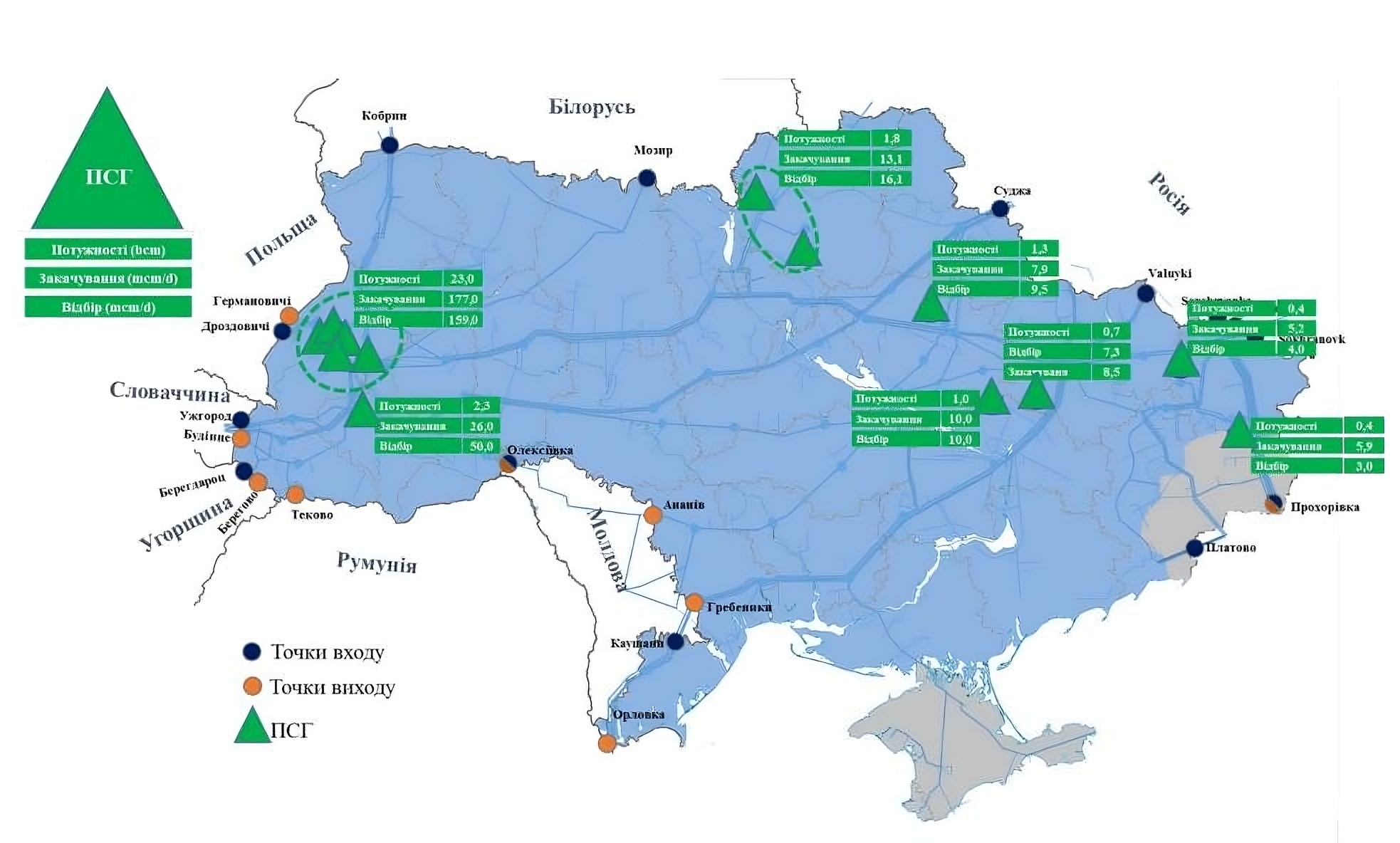

Despite the war, Ukraine remains a significant player in the region. With 12 underground storage facilities with an active capacity of over 31 billion m³, we have already proven our ability to serve as the largest safe for the EU. In customs warehouse mode and during stress tests in the winter of 2023/24, we demonstrated the ability to safely re-export accumulated volumes back to the EU thanks to the flexibility of the gas transmission system and UGS reserves. At the same time, in the spring of 2025, UGS stocks fell to their lowest level in at least 11 years (over 6 billion m³ as of 11 May), highlighting the need for a rapid recovery in production and guaranteed import routes for the 2025/26 season. Map of Ukrainian UGS facilities. Source: JSC Ukrtransgaz

Map of Ukrainian UGS facilities. Source: JSC Ukrtransgaz

Following the adoption of REMIT (European standards for trading transparency) and the launch of trading data on the Ukrainian energy exchange in 2024, the market is becoming more transparent and closer to EU rules – the basis for liquidity and investor confidence. Added to this is the integration of routes: Ukraine has joined the Memorandum on the Vertical Corridor, which opens up south-north flows of LNG and Black Sea gas to Central Europe.

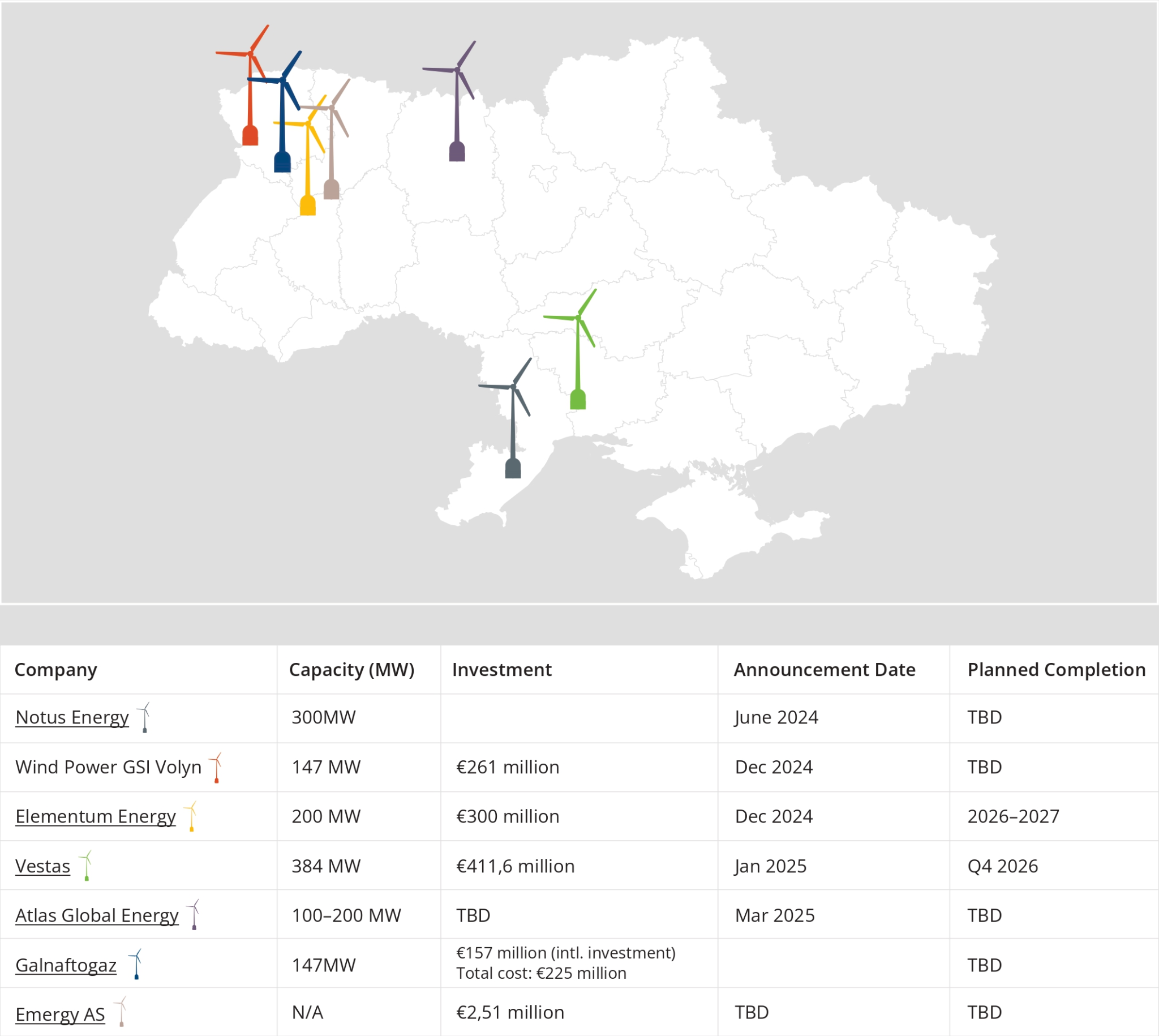

Our own balance has also become tighter. Since 2022, when consumption fell to ≈19.8 billion m³ and production lagged only slightly behind at ≈18.5 billion m³, we still maintain a deficit of ≈3 billion m³. With modernisation and increased drilling - is a springboard to actual self-sufficiency after the war. In terms of infrastructure, we are ahead of production capabilities: inter-state connections with all neighbours are sufficient for current needs and even excessive given the shutdown of Russian transit. Therefore, Ukraine is ready to become a storage facility, transit country and marketplace for the region. New projects in Ukraine's wind energy sector. Source: The German-Ukrainian Energy Partnership

New projects in Ukraine's wind energy sector. Source: The German-Ukrainian Energy Partnership

The Black Sea market is moving without us — but not against us. Our task is to reconfigure our infrastructure and policies so that after the war we can quickly take advantage of the window of opportunity: gas reverse flow, export of green electricity, and our own offshore geology. Our risks are the uncertainty of war, outdated generating assets, and the need for capital for offshore projects.

The Black Sea is entering a decade where gas and green electricity will work together. The EU is bringing the region into a single system, reducing dependence on Russia and increasing autonomy through its own resources, networks, and ports. Turkey and Romania are already setting the pace, Bulgaria is maturing for a breakthrough.

Ukraine is not a spectator: we have a market and sought-after gas storage facilities. The EU's course is not to ‘bypass’ Ukraine, but to create interchangeable routes and capacity reserves. If we establish ourselves in these chains — reverse connections, joint protocols with Romania/Bulgaria/Moldova, and participation in green projects — we will not only return, but also cement our own energy stability.

You may be interested