INFORMATION AND ANALYTICAL

COMMUNITY

+ Join

Support

RESURGAM EDITORIAL

Collage Glavred, Photo - ua.depositphotos.com

Collage Glavred, Photo - ua.depositphotos.com

To understand, how structural the crisis in Russia is, we looked at the country's regional budgets.

According to the Federal Treasury, in the first half of 2025, the consolidated budget deficit of the Russian Federation increased to 4.95 trillion roubles.

The consolidated budget should be distinguished from the federal budget. The federal budget is approved by law. The consolidated budget combines, in addition to the federal budget, all budgets of the subjects of the Russian Federation and local budgets (municipalities) and is primarily an analytical tool.

In January-May, the federal budget deficit amounted to 4 trillion 443.6 billion roubles (preliminary data from the Ministry of Finance showed a deficit of 3.4 trillion roubles for this period).

The consolidated budgets of the subjects of the Russian Federation in January-June were in deficit by 397.8 billion roubles, while in the same period of 2024, on the contrary, there was a surplus of 855.8 billion roubles. In total, local budgets had a deficit of 297.4 billion roubles in 2024.

In other words, in the third and fourth quarters of 2024, the entire surplus accumulated by local budgets disappeared, and by the end of the year, the regions had a deficit, which increased until mid-2025. How did this happen?

At the end of 2023, in order to avoid unpopular and politically dangerous mobilisation, the Kremlin began to shift responsibility (plans) for recruiting new recruits to the regions with the requirement to ‘increase incentives’. As long as there were enough volunteers, additional regional payments grew moderately and were affordable for local budgets.

But during the first and second quarters of 2024, the flow of volunteers began to weaken. According to the Russian Ministry of Defence, 540,000 recruits were enlisted in 2023, but between January and July 2024, only 190,000 people were enlisted, according to Dmitry Medvedev, deputy chairman of the Russian Security Council (surprisingly, Medvedev's figures on the speed of mobilisation are usually close to analysts' estimates, unlike all his other statements).

In order to maintain the level of mobilisation plan provided by Kremlin, the regions amplified the headhunting competition. Moreover, the surplus in local budgets allowed for an increase in one-off incentive payments, and the regions' accumulated reserves increased as well. For example, in March, the bonus in the Nizhny Novgorod region increased to 500,000 roubles, meaning that, together with the federal payment of 195,000 roubles, military personnel received 695,000 roubles.

In April, the Nizhny Novgorod and Krasnodar regions raised regional payments to 1 million roubles.

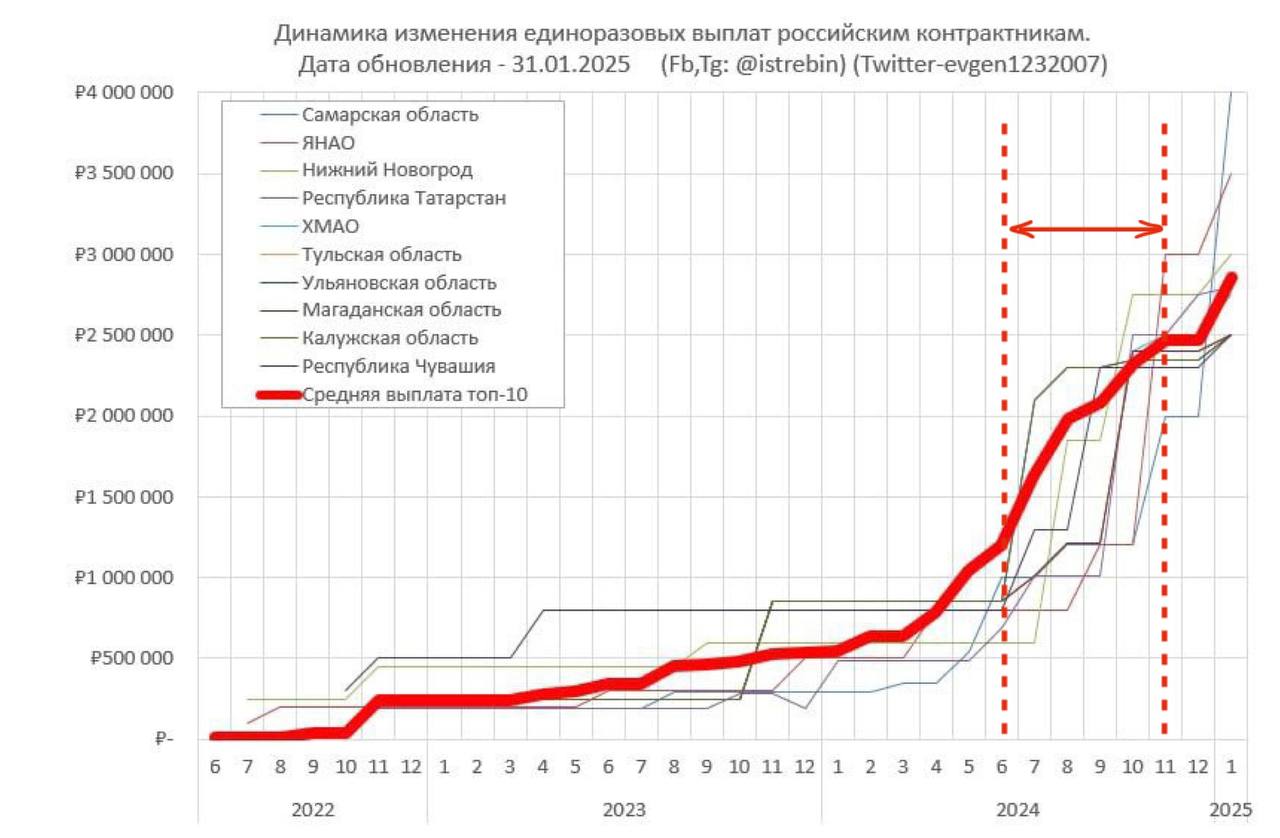

As can be seen in the graph below, growth in payments intensified between June and November.

Dynamics of changes in one-time payments to Russian contract soldiers (average payment amount in the top 10 Russian regions). Source: Istrebin.UA

Dynamics of changes in one-time payments to Russian contract soldiers (average payment amount in the top 10 Russian regions). Source: Istrebin.UA

Regions with large surpluses (some from stabilised energy prices, others from additional taxes from the military-industrial complex) started competing to meet military recruitment goals, i.e. mobilisation.

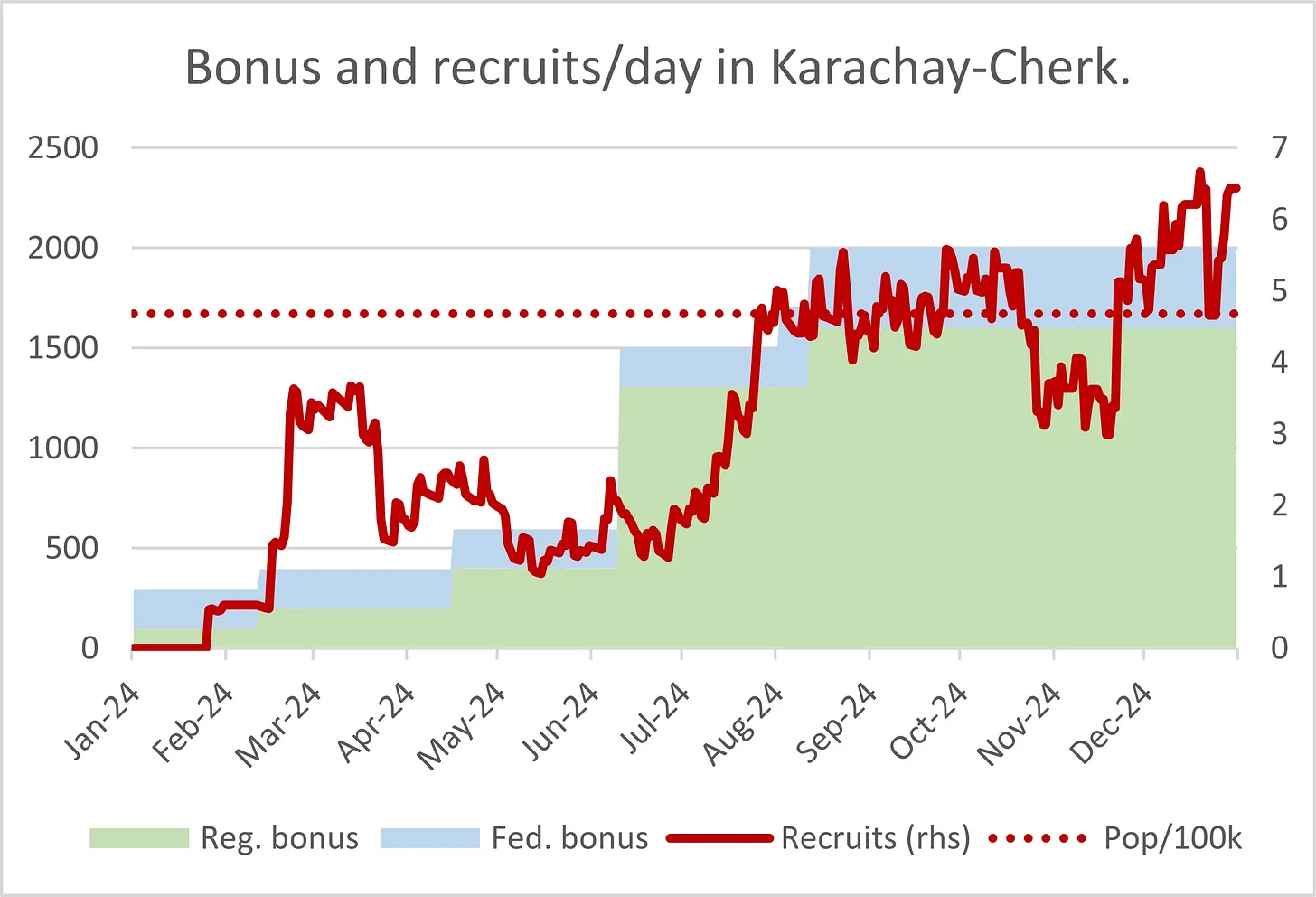

As a result, in August alone, 47 regions raised their bonuses, and the size of the largest regional payments increased one and a half times over the next three months. If as of 13 August 2024, the three most generous regions were Moscow (1.9 million roubles), St. Petersburg (1.7 million) and Karachay-Cherkessia (1.6 million), by 22 November, the leaders of the ranking were the Belgorod and Nizhny Novgorod regions (2.6 million each) and the Khanty-Mansi Autonomous District (2.2 million), according to the project Re: Russia.

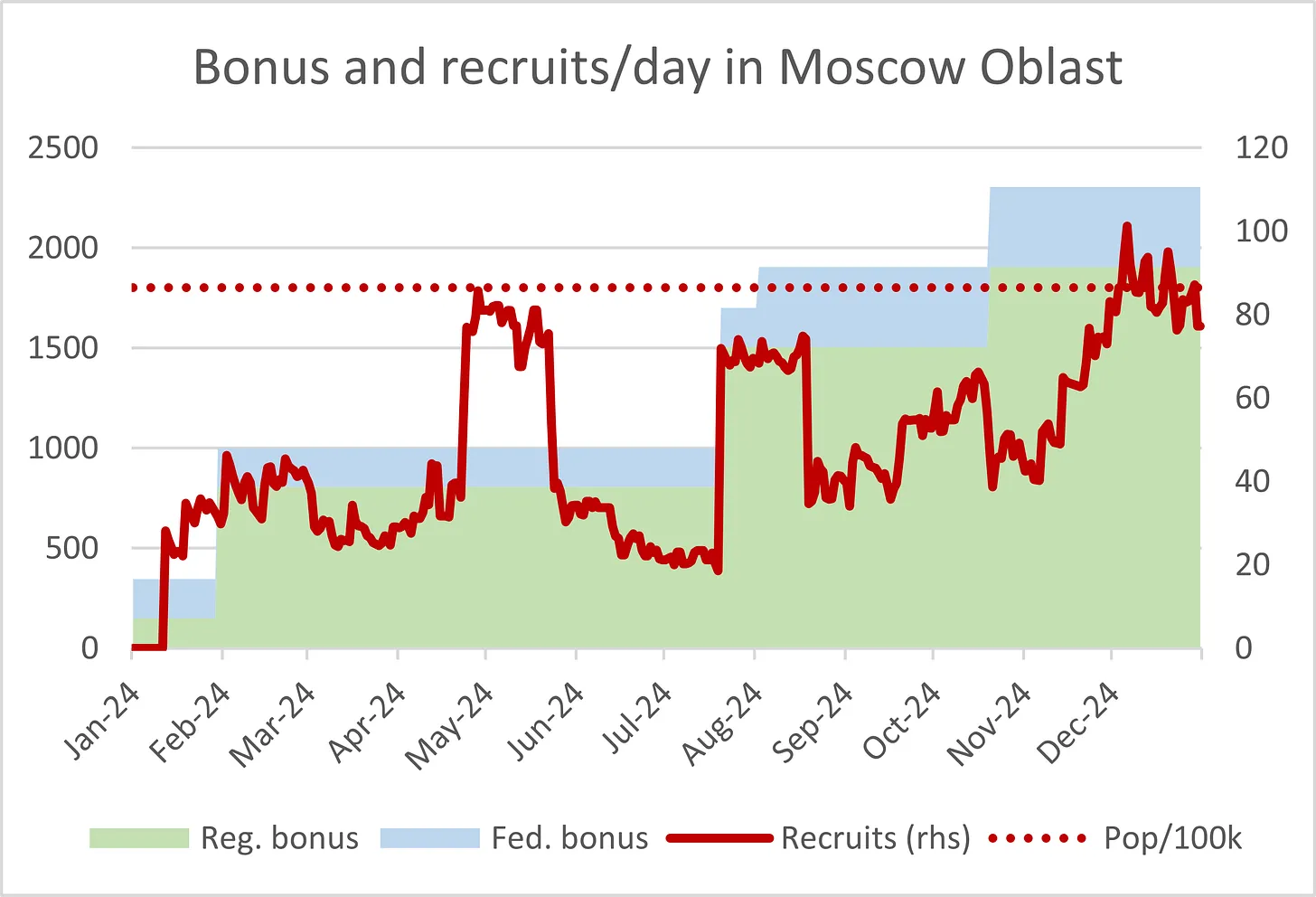

The size of regional (green) and federal payments (blue) and the rate of military recruitment per day (red line) in the Moscow region during 2024. Source: Janis Kluge

The size of regional (green) and federal payments (blue) and the rate of military recruitment per day (red line) in the Moscow region during 2024. Source: Janis Kluge

The size of regional (green) and federal payments (blue) and the rate of military recruitment per day (red line) in Karachay-Cherkessia in 2024. Source: Janis KlugeAt the beginning of 2025, regional payments also increased in many regions. As of 30 January 2025, the largest regional payments were offered by the Samara Region (3.6 million roubles), the Nizhny Novgorod Region (2.6 million) and the Khanty-Mansi Autonomous District (2.2 million).

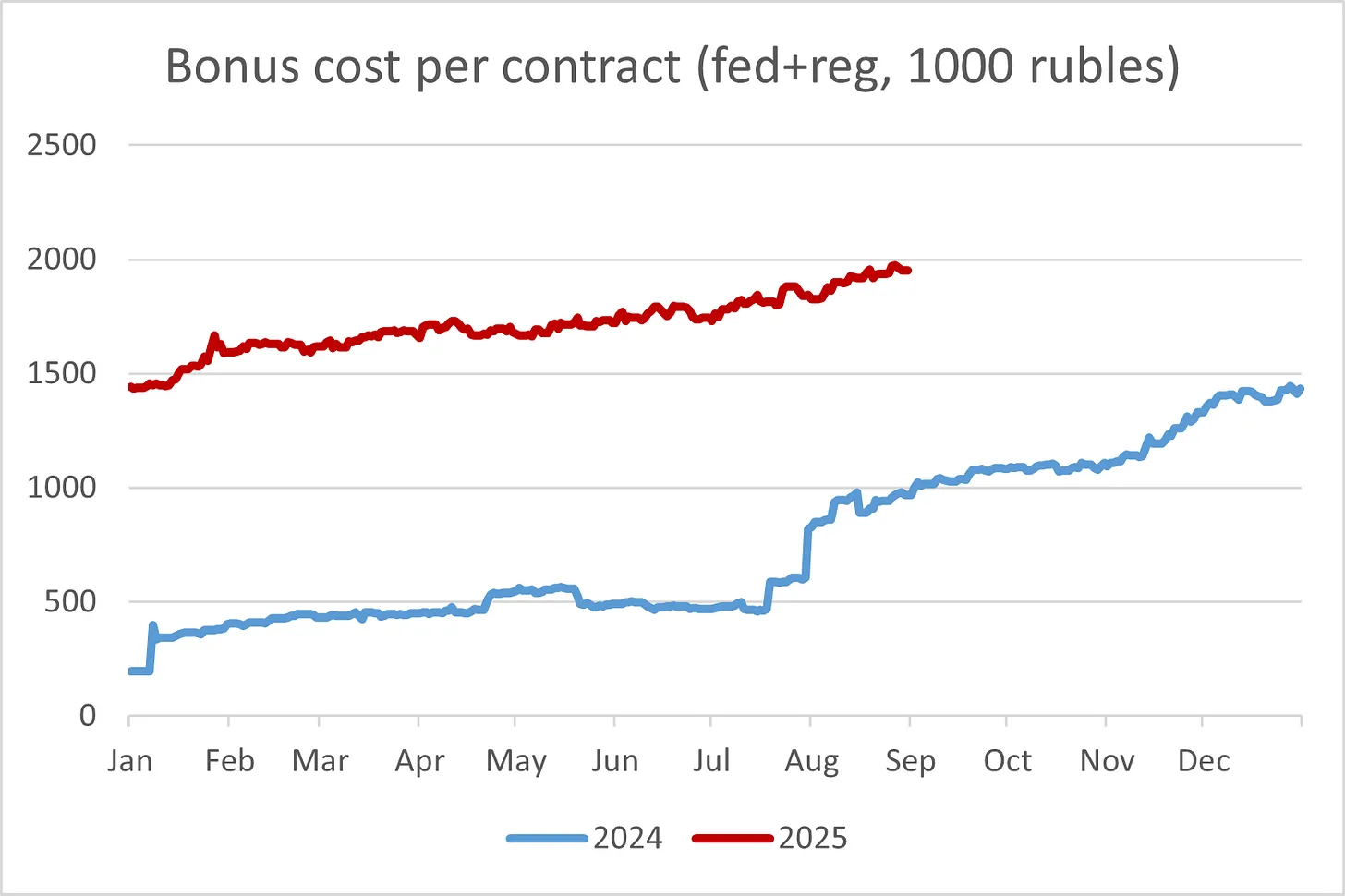

The size of regional (green) and federal payments (blue) and the rate of military recruitment per day (red line) in Karachay-Cherkessia in 2024. Source: Janis KlugeAt the beginning of 2025, regional payments also increased in many regions. As of 30 January 2025, the largest regional payments were offered by the Samara Region (3.6 million roubles), the Nizhny Novgorod Region (2.6 million) and the Khanty-Mansi Autonomous District (2.2 million). Cost of the bonus for signing a contract (federal plus regional payment, thousand rubles). Source: Janis Klug's own calculations based on data from the Ministry of Finance

Cost of the bonus for signing a contract (federal plus regional payment, thousand rubles). Source: Janis Klug's own calculations based on data from the Ministry of Finance

Economists believe that the reduction in payments in the regions where it was recorded may be due to the growing budget deficit. In May, the Bashkortostan State Assembly amended the 2025 budget law, increasing the deficit to 3% – from 4 billion roubles to 9.8 billion. In the Nizhny Novgorod and Samara regions, the budget deficit at the end of the first quarter was 19% and 6% respectively.

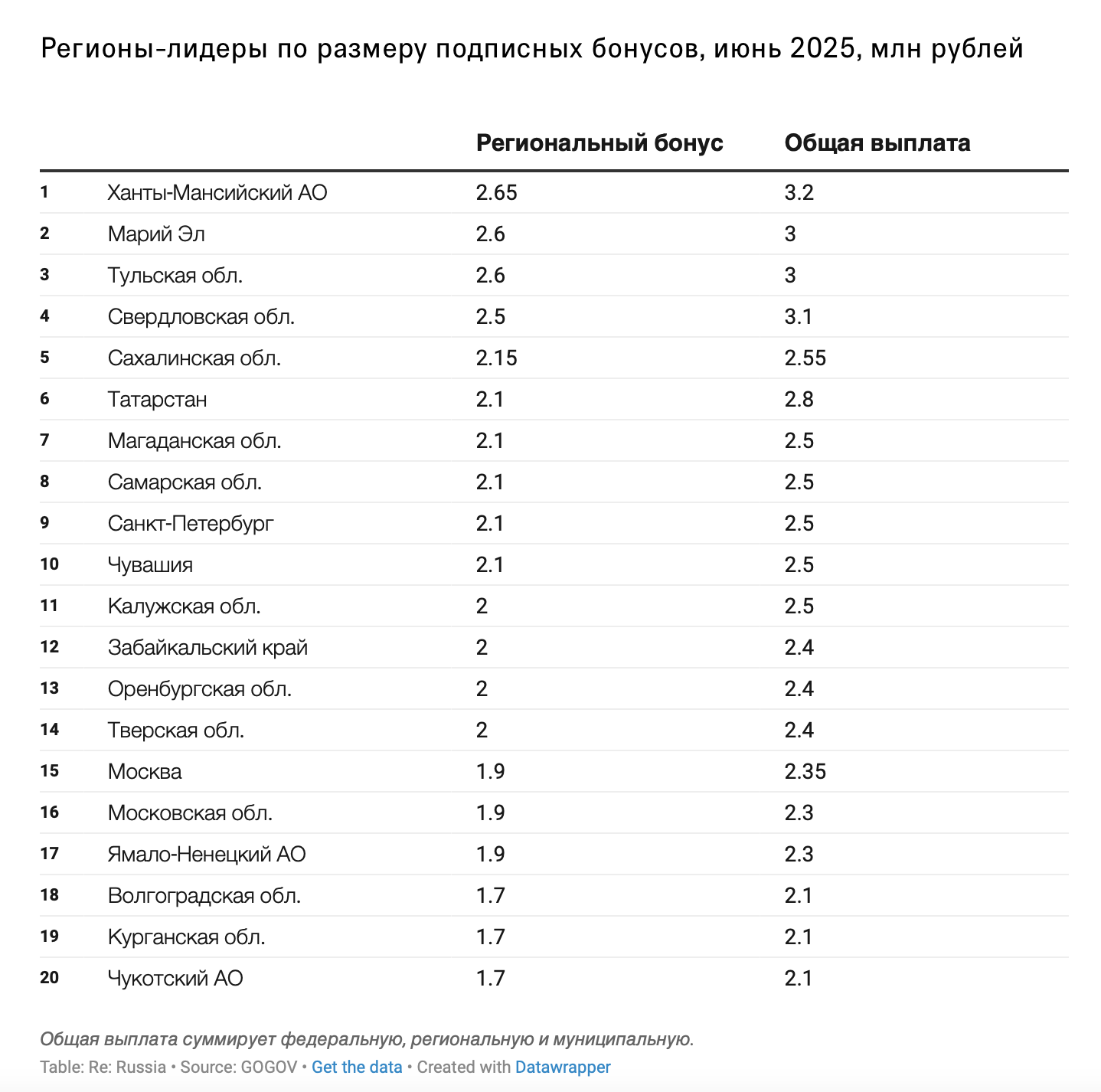

In June 2025, a new round of pay rises began. At the end of June, the top three regions (Mari El Republic, Nizhny Novgorod Region and Sverdlovsk Region) offered contract workers a total bonus averaging 2.62 million roubles. Also in August, the Main Intelligence Directorate of the Ministry of Defence of Ukraine reported that in Tatarstan, the bonus was raised to 3.1 million roubles, in the Ryazan Region, they promised to pay an additional 1 million, and in Kabardino-Balkaria, the amount was increased from 1.5 to 1.8 million.

According to Janis Kluge's calculations, the pace of contract soldier recruitment increased rapidly at the end of 2024, from approximately 750 people per day in August to approximately 1,700 per day in January 2025. After a decline, the rate stabilised at 1,200-1,300 people per day in March-April. In the summer, Russia recruited approximately 1,000 people per day.

Kluge's approach to calculating the rate of military recruitment is based on an analysis of data on regional bonuses paid for signing contracts. Kluge summarises budget statistics from 37 regions, which account for 43% of Russia's population, and then extrapolates the data to the whole country. Military recruitment pace in Russia in 2024-2025. Source: Janis Kluge's calculations based on data from the Ministry of Finance

Military recruitment pace in Russia in 2024-2025. Source: Janis Kluge's calculations based on data from the Ministry of Finance

Approximate estimate of manpower costs in the first half of 2025. Source: Re: RussiaAccording to Re: Russia's calculations, payments and budget liabilities at all levels to provide manpower for the war in the first half of 2025 amount to approximately just over 2 trillion roubles. Of this, 20% (about 400 billion) is for signing bonuses; slightly more than 40% (865 billion) is for salaries for soldiers; and slightly less than 40% (765 billion) is for payments to the killed and wounded.

Approximate estimate of manpower costs in the first half of 2025. Source: Re: RussiaAccording to Re: Russia's calculations, payments and budget liabilities at all levels to provide manpower for the war in the first half of 2025 amount to approximately just over 2 trillion roubles. Of this, 20% (about 400 billion) is for signing bonuses; slightly more than 40% (865 billion) is for salaries for soldiers; and slightly less than 40% (765 billion) is for payments to the killed and wounded.Accordingly, if the dynamics of losses and military recruitment remain unchanged, these costs will amount to more than 4 trillion roubles per year, which is equivalent to 9.5% of the expected federal budget expenditure in 2025, 5.5% of the consolidated budget expenditure in 2024 and 2% of Russia's GDP.

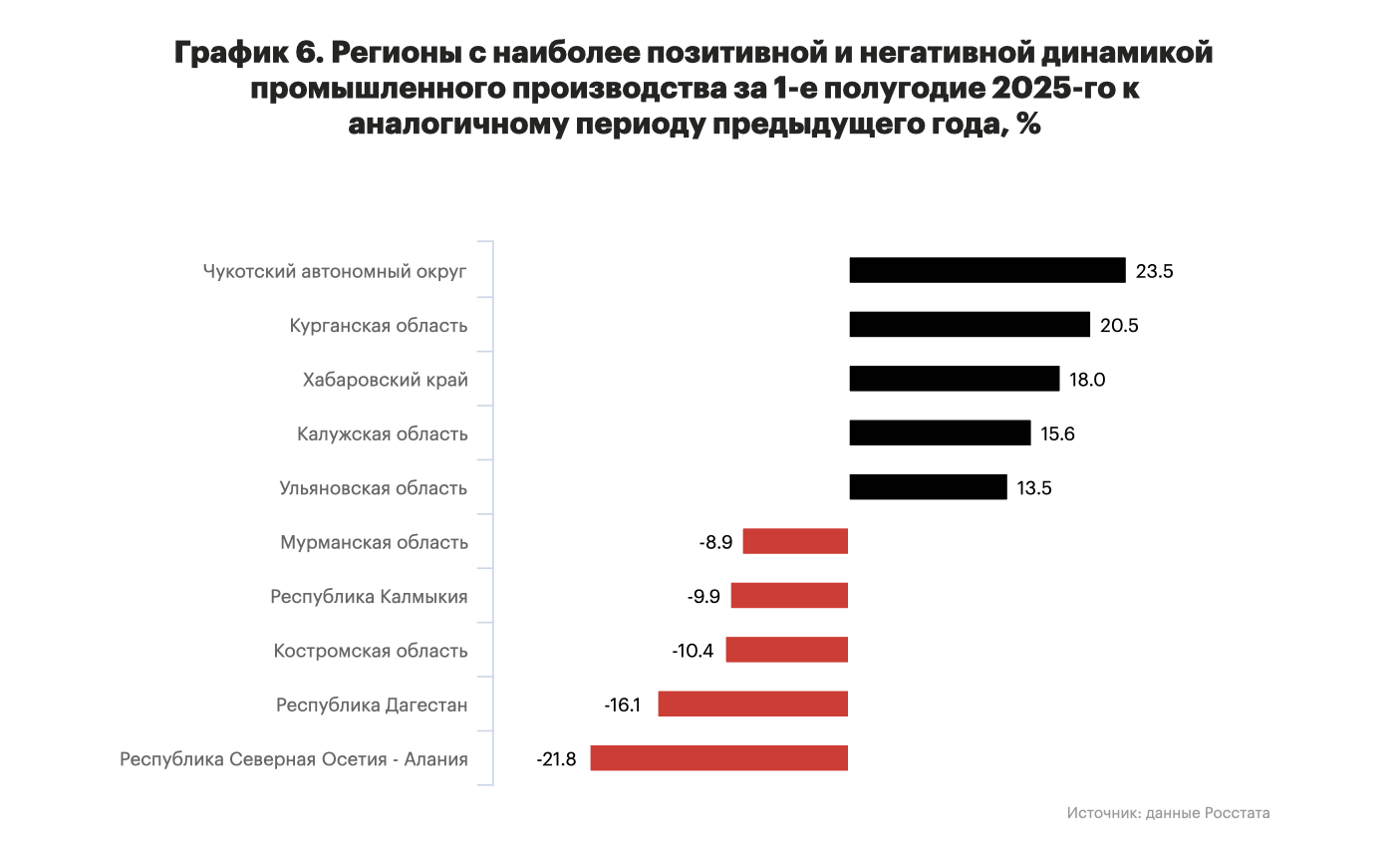

Almost every second region of the Russian Federation is already in industrial recession. According to the results of the first half of the year, only 46 out of 85 subjects of the Russian Federation showed growth in industrial production (including the military-industrial complex). The main feature is unevenness, as a number of regions showed a double-digit decline in industrial production.

The industrial collapse was recorded in: North Ossetia - Alania (-21.8%), Dagestan (-16.1%) and the Kostroma Region (-10.4%). Kalmykia (-9.9%) and Murmansk Region (-8.9%) were also among the top five anti-leaders. Regions with the most positive and negative dynamics of industrial production in the first half of 2025 compared to the same period of the previous year, %. Source: Rosstat

Regions with the most positive and negative dynamics of industrial production in the first half of 2025 compared to the same period of the previous year, %. Source: Rosstat

35 out of 85 regions faced a decline in local budget revenues. The main headache for governors was the collection of income tax, a key source of money for the regions, which provides them with every third rouble of their own revenues.

In total, the regions lost 223 billion roubles in income tax compared to last year (-7.8%). At the same time, the decline was catastrophic in a number of regions: -53.9% in the Komi Republic, -43.6% in Karelia, -35.5% in the Nenets Autonomous District, and -33.3% in the Chelyabinsk Region.

Income tax will be one of the hidden holes in the Kremlin's budget. At the beginning of 2025, the tax was increased from 20% to 25%, and, accordingly, the central and local budgets were based on expectations of an increase in the tax base.

Due to the fact that budget planning did not take into account the economic slowdown and transition to recession, which inevitably affects economic activity and, accordingly, income tax revenues, this is causing additional problems for the Kremlin right now.

Rosstat reports that industry grew by 0.8% in the first seven months of this year. However, this is seven times less than last year, when production volumes increased by 5.6%. And this is no longer enough. VEB is already recording a technical recession (GDP fell by 0.5% in the first quarter and by 0.6% in the second one). Another quarter of decline, and we can talk about recession as a permanent trend.

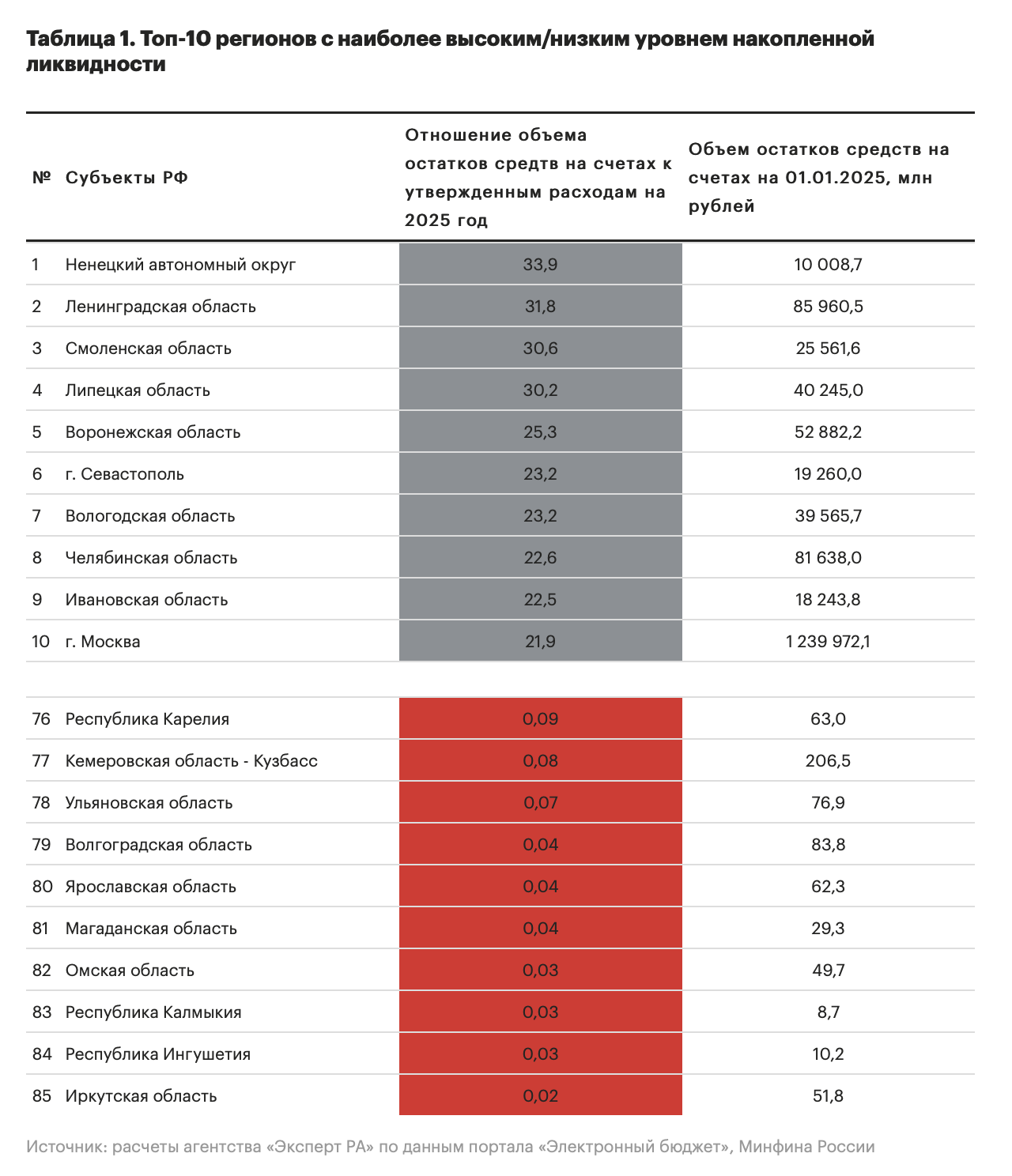

In 2024, regions covered the deficit with existing local budget savings, but this led to the depletion of local liquid reserve funds, even though the nominal volume of funds increased.

The reserves of 10 out of 83 subjects of the Russian Federation were depleted (excluding the occupied territories). Regions like Ingushetia, Kalmykia, Omsk, Magadan, Yaroslavl and other regions and areas started 2025 with reserve funds ranging from 0.02% to 0.1% of annual local budget expenditures.

Another 54 out of 83, after covering the deficit in 2024, had reserve funds in their accounts amounting to only 10% of their annual needs. Top 10 regions with the highest/lowest level of accumulated liquidity. Source: calculations by the Expert RA agency based on data from the Electronic Budget portal, Russian Ministry of Finance

Top 10 regions with the highest/lowest level of accumulated liquidity. Source: calculations by the Expert RA agency based on data from the Electronic Budget portal, Russian Ministry of Finance

Moscow experts expect that by the end of the year, the local budget deficit will grow to a total of 1.9 trillion roubles. The available reserves in local budgets will only be enough to cover about 40% of the accumulated deficit in 2025. This is despite the fact that local budget reserves total 2.9 trillion, but most of these funds are invested in government bonds or are used as collateral for loans. Another reason: 40% of local reserves from all 83 subjects are in Moscow.

If we take into account only regional and federal one-time payments, the average cost of hiring a contract soldier has increased from 1.5 million roubles in January 2025 to approximately 2 million roubles today. Janis Kluge suggests that by the end of 2025, the cost of one soldier is likely to rise to 2.5 million roubles.

This is expensive. According to estimates, almost 35,000 new military contracts were signed in August. At 2 million roubles per soldier, signing 35,000 contracts will cost 70 billion roubles (840 billion roubles per year, if we extrapolate this data). And this is far from the full picture, as federal and regional payments are only part of the recruitment costs.

In theory, Russia could continue military recruitment based on a model of costly financial incentives for at least another year, as Kluge writes. But at some point, the Kremlin may be forced to abandon this model in favour of a full-scale mobilisation, as it did in September 2022.

Regional budgets currently pay most of the one-off bonus payments. However, regions will soon have to address the issue of budget deficits (some have already begun to do so).

They have two options:

Request additional funding from the federal budget or take out high-interest loans.

Cut their own spending.

The problem with the first option is that the federal budget already has a record deficit of almost 5 trillion roubles for the first seven months of the year. It is unlikely that there will be an extra 1-2 trillion roubles available to supplement local budgets.

That leaves russian occupants with the second option. A significant portion of local budgets in the first half of the year has already undergone sequestration (spending cuts). However, local payments for signing contracts have largely remained untouched. At the end of the year, local budgets will likely face a dilemma of what to do with contract payments, which are a key motivation for signing.

After all, now we can see an increase in reports of various forms of persuasion and coercion to sign contracts among recruits. The number of such cases rose sharply in June across Russia, according to the publication Verstka. In the Trans-Baikal region, the Ministry of Culture has ordered cultural institutions (museums, theatres, libraries, etc.) to assist military recruitment offices in finding volunteers for the war. The Ministry of Defence is increasingly targeting volunteers through online job ads. Regional ministries of education are offering military contracts to unsuccessful students.

Obviously, due to a lack of money, Russia is trying to stop or even reduce the growth of one-time payments, while maintaining the pace of recruitment of contract soldiers through coercion, Re: Russia sadly states.

Due to the intensification of economic and financial problems, which will negatively affect the pace of such mobilisation, the Kremlin may become more compliant with the war. Or, in the end, it may continue the war and risk everything (the economy, geopolitical positions and even the ability to hold occupied territories).

Russia will likely try to use the narrowing window of opportunity to conduct another large-scale offensive campaign to finally turn the tide of battle in its favour, which could allow it to achieve most or all of its war aims. But the price is high, and the outcome is far from guaranteed.

Donald Trump remains the key problem. Not even because of his unwillingness to increase pressure on Russia, but because he provides the Kremlin with a guaranteed exit (freeze) from the war in order to secure the occupied territories as soon as the situation becomes strategically unfavourable for the Russians.

RESURGAM EDITORIAL

You may be interested