INFORMATION AND ANALYTICAL

COMMUNITY

+ Join

Support

Anatolii Horschkov, especially for the international information and analytical community Resurgam

Photo: Getty Images

Photo: Getty Images

Revenues from the sale of oil and petroleum products have traditionally financed not only social programmes but also the large-scale military-industrial complex. Therefore, the fuel problems we see in this country today are, without exaggeration, critical for Russia.

Before analysing the current fuel crisis, it is worth remembering that back in September 2023, the Russian Federation faced a smaller version of it in the territories bordering Ukraine, as well as in occupied Crimea.

At that time, the shortage was caused by the need for large amounts of fuel, not just for military needs, but also for agricultural work. And because of the priority given to the military, other consumers experienced a pretty serious shortage.

And in the first half of 2024, the most effective sanctions against Russia started to be introduced, but this time by Ukraine. These were strikes by long-range drones on Russian oil refineries.

It all started with rather insignificant occurrences. On the night of 18 January 2024, Ukrainian strike UAVs attacked the St. Petersburg oil terminal. Over the next two days, strikes were carried out on an oil refinery in Klintsy, Bryansk Oblast, resulting in oil tanks burning for two days. This was followed by a series of strikes on oil refineries and oil terminals in Ust-Luga, Tuapse, Yaroslavl, and Volgograd.

Thus, according to Bloomberg, as of 19 February 2024, enterprises processing 18% of Russian oil had been attacked.

In 2025, Ukraine significantly increased the number and effectiveness of its deep strikes. Ukrainian attacks have already disabled 17% of the aggressor country's capacity. According to Reuters estimates, this amounts to more than one million barrels per day. The biggest loss is the destruction of "cracking units". They convert crude oil into finished fuel. Replacing them under sanctions is almost impossible.

At the end of September, the Russian government imposed a ban on gasoline exports and a partial ban on diesel until the end of the year. Although the Kremlin tried to present these steps as “temporary measures to stabilise the domestic market,” in reality, they were evidence of deep systemic problems in the country's oil refining industry.

In addition, as part of efforts to reduce the fuel shortage in the domestic market, Russia began actively importing petrol from... Belarus. In September, import volumes increased fourfold, and Minsk became the main source of operational fuel supplies for Russian regions.

As a result of strikes on refineries and a decline in refining volumes, Russia is beginning to face an overflow of oil reserves. Crude oil is accumulating in tanks, cannot be processed in time, and therefore has to be sold.

Despite internal restrictions, crude oil exports in September increased by 25% compared to August. It may seem that in this case, the situation in Russia is not critical. However, it is important to note that for Russia, crude oil exports are more of a necessity due to the inability to process it.

Fun fact, petroleum products have always been more profitable than crude oil. When processed, one tonne of oil yields a lot of petrol, diesel and black oil. Each of these products is significantly more expensive than crude oil.

This creates an interesting situation: instead of refining oil at its own plants, Russia is forced to export it, especially when global oil prices fall due to oversupply. After that, other countries buy, refine and sell Russian crude oil.

In fact, the problems in the Russian oil industry began neither this year nor even after 2022.

The Soviet Union built its economy on oil back in the 1960s. Russia inherited the huge deposits of the Volga region and Western Siberia as an oil legacy and continued to use it as a source of prosperity.

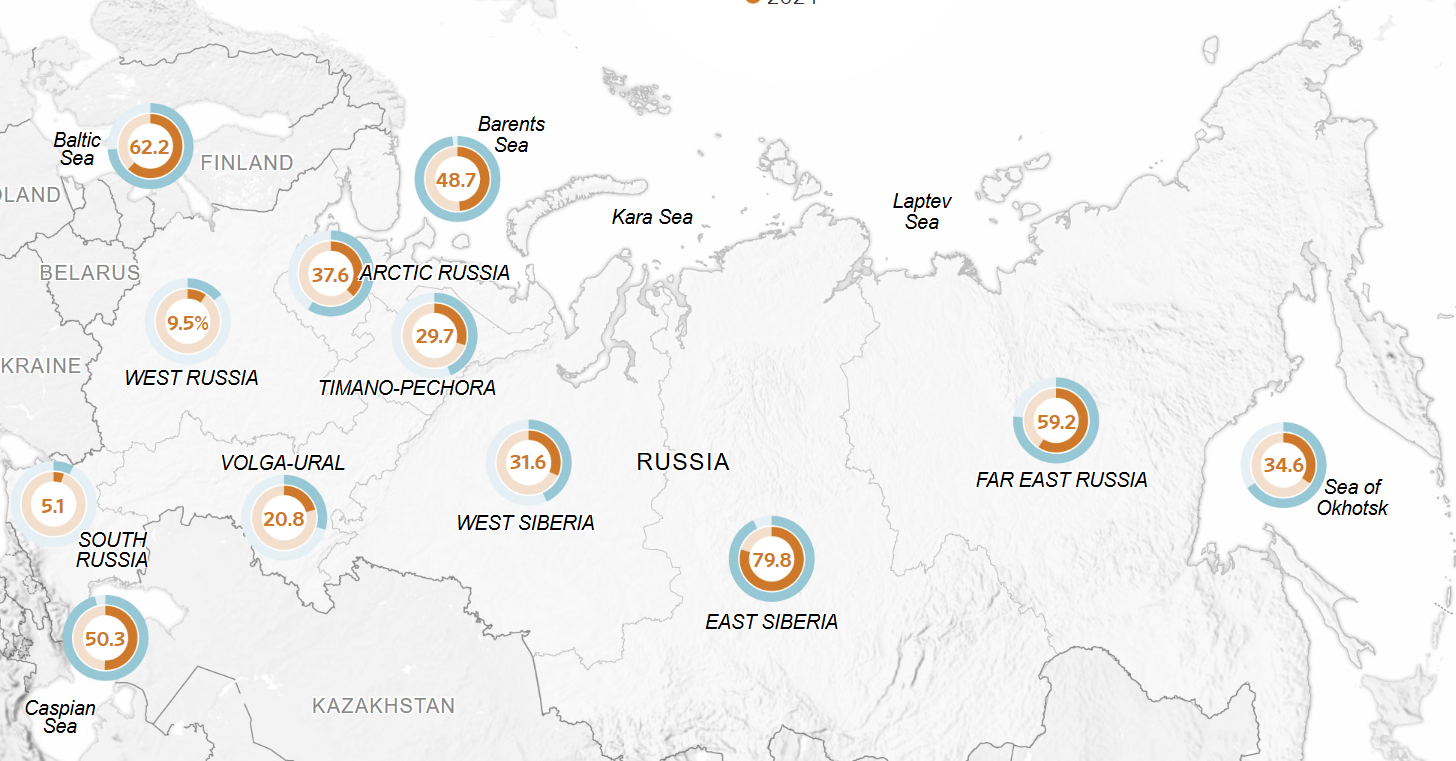

But even before 2022, the industry was already facing serious problems. The giant fields of the Soviet era started to dry up. Easily accessible oil was running out, and new ways of extraction had to be found. Russia's oil reserves. Wall Street Journal

Russia's oil reserves. Wall Street Journal

Russian companies planned to use American technology to develop the fields, but sanctions ruined those plans.

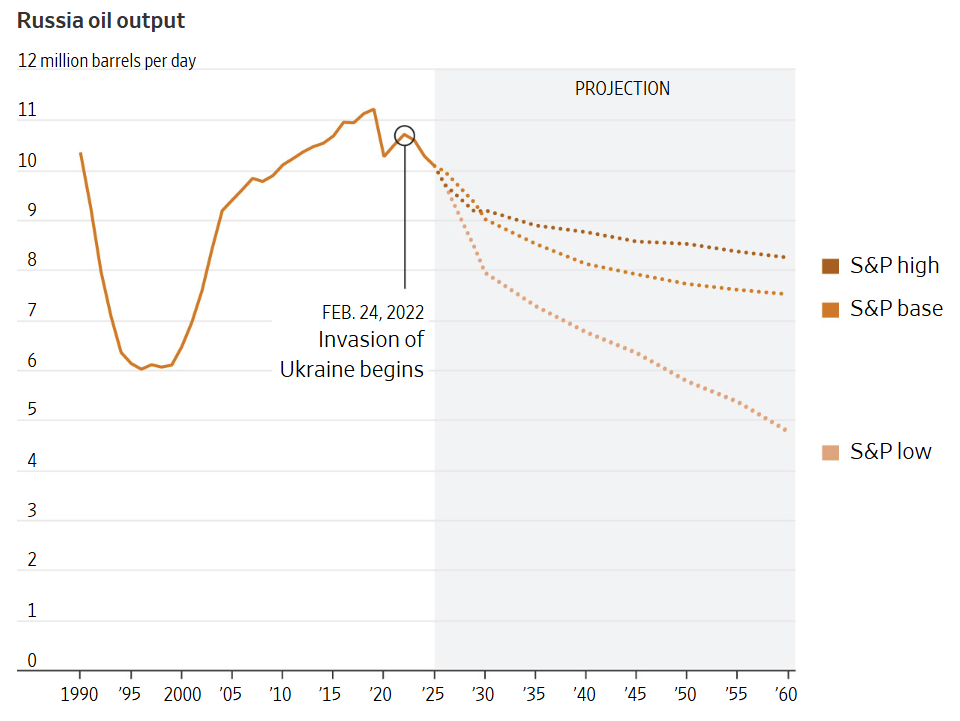

As a result, the share of hard-to-reach oil reserves in Russia is constantly growing, and the current crisis is destroying the already difficult situation with oil refining and production even further. Oil production in Russia. S&P Global

Oil production in Russia. S&P Global

The fuel crisis has every chance of becoming one of the main problems of modern Russia, and in the long term, even one of the main factors in its loss in the war.

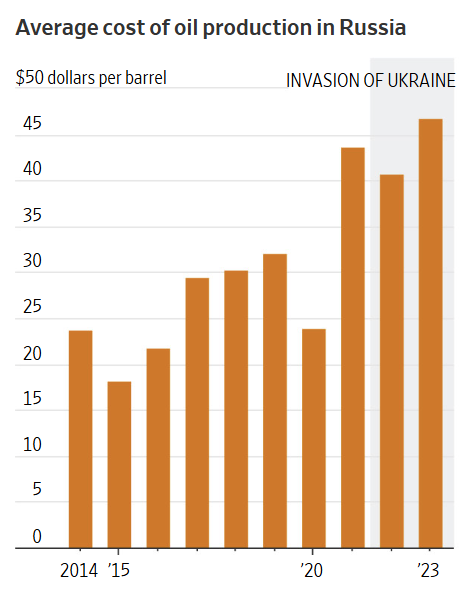

Although no single Ukrainian strike on an oil refinery is critical, the cumulative effect of constant attacks is depleting the system faster than it can recover. The lack of spare parts and technology makes each subsequent repair more difficult and time-consuming, and extraction more expensive. Average cost of oil production in Russia. S&P Global

Average cost of oil production in Russia. S&P Global

All this is happening against the backdrop of a budget deficit that has grown fivefold compared to 2024.

In the short term, the crisis will only deepen. While in 2024 the strikes on refineries were perceived by Moscow as just temporary setbacks, in 2025 it's clear that it's not possible to quickly restore lost capacity, and in some cases it's just not realistic without Western tech. This means a gradual decline in the depth of processing, a transition to more primitive schemes, and a loss of profitability for the industry.

For the domestic market, this means prolonged fuel shortages. Despite official statements, Russians are more and more often faced with queues at petrol stations and rapidly rising prices. The fuel shortage inevitably affects the cost of logistics, food products and the survival rate of Russians.

In addition, fuel is a basic resource for transport, agriculture and the army. The Kremlin is forced to give priority to the military, but even for the army, the situation does not look stable. The lack of high-quality diesel and jet fuel will begin to significantly reduce mobility and combat capability.

In the medium term, the crisis could turn into a systemic energy disaster, forcing the government to cut spending in other areas, from social programmes to regional subsidies.

At the same time, it would be imprudent to claim that the Russian oil industry is about to collapse completely. Russia still has significant reserves of crude oil, export opportunities and resources to temporarily ‘“patch up the holes”. The Kremlin will try to hold off the crisis by any means necessary, using administrative restrictions, imports from Belarus, or even additional discounts for Asian buyers.

However, the key problem is that the current difficulties are not short-term or accidental. They are systemic in nature and are getting worse every month. It is more like a process of slow depletion, which is quite difficult to stop quickly.

Therefore, the Russian economy may continue to show signs of stability for some time, but the trends towards stagnation and degradation are already inherent within it. And it is these hidden, cumulative effects that are likely to become one of the decisive reasons for Russia's weakening in the coming years.

For Ukraine, the Russian fuel crisis opens up a unique strategic window of opportunity. First, the gradual depletion of the enemy's fuel system reduces its ability to wage a prolonged, high-intensity war. This means that time is starting to play in Kyiv's favour: the longer the war lasts, the greater Moscow's costs will be to maintain even a basic level of combat readiness.

Secondly, the crisis in oil refining creates a tool of indirect influence for Ukraine, or so-called ‘cards’ for negotiations. Each new strike on an oil refinery or terminal not only causes direct damage to the Russian economy, but also aggravates existing problems, forcing the Kremlin to spend resources on repairs, protecting facilities and searching for alternative sources of supply.

This opens up space for asymmetric actions, where relatively small Ukrainian investments in drones or missiles lead to disproportionately large losses for the enemy.

It seems logical to continue the strategy of striking oil refineries. In the long run, this will worsen the situation, proving that Russia is a ‘colossus with feet of clay’ that could collapse at any moment.

You may be interested