INFORMATION AND ANALYTICAL

COMMUNITY

+ Join

Support

RESURGAM EDITORIAL

Photo: Shutterstock

Photo: Shutterstock

As a result, global oil prices are falling, which hits Russia's budget, which consists of about one-third oil and gas revenues. Lower oil prices mean lower military spending by Russia in the war against Ukraine. How will the increase in global oil supply affect Russia's capabilities?

At the end of 2025, the oil market is likely to see an even greater supply surplus than previously expected, the International Energy Agency (IEA) said in its latest monthly report on 13 August.

According to the IEA forecast, global oil supply will increase by 370,000 barrels per day (bpd) to 2.5 million bpd this year, compared to 2.1 million bpd in the previous forecast. In 2026, supply will increase by 620,000 barrels per day to 1.9 million bpd.

Since the beginning of the year, the MEA has repeatedly lowered its forecast for global oil demand growth in 2025 – by a total of 350,000 barrels per day. In its last report in July, the IEA said that global oil demand would only grow by 700,000 barrels per day in 2025, which is the lowest since 2009 (except for 2020, when the Covid pandemic hit). In its August report, the agency reduced its forecast for global demand growth by another 20,000 barrels per day to 680,000 bpd this year. In 2026, global demand will grow by 700,000 barrels per day, reaching 104.4 million bpd.

The latest data indicate weak demand in leading economies. Consumption in transition economies and developing countries has been weaker than expected, and forecasts for China, Brazil, Egypt and India have been lowered compared to July.

As always, the International Energy Agency is more pessimistic about oil demand growth than OPEC, which said in its 12 August report that demand should rise in 2026 thanks to stronger economies in key oil-consuming regions. According to OPEC, global oil demand will grow by 1.38 million barrels next year, which is 100,000 more than the previous forecast and almost twice as much as the MEA forecasts. Total oil supply from non-OPEC+ countries will increase by approximately 630,000 barrels per day in 2026, OPEC reports, compared to last month's forecast of 730,000 barrels per day.

In July, volatility in oil markets fell to near historic lows, with Brent crude futures hovering around $70 per barrel. However, in the first half of August, oil prices fell to around $66-67 per barrel due to OPEC+'s decision to increase production and the prospect of unstable stockpiling in the second half of the year. Wall Street analysts, including JPMorgan and Goldman Sachs, predict that prices will fall to $60 per barrel by the end of the year.

OPEC+ oil-producing countries and non-OPEC+ producers are increasing oil production. According to the IEA, OPEC+ supply of oil and natural gas liquids (NGLs) will increase by 1.1 million barrels per day this year and 890,000 bpd in 2026. However, non-OPEC+ countries, such as the United States, Canada, Brazil and Guyana, continue to lead the growth in production and will add 1.3 million barrels per day in 2025 and 1 million bpd in 2026.

OPEC+. On 3 August, eight OPEC+ members agreed to increase oil production by another 547,000 barrels per day in September. This brings the accelerated cancellation of the 2.2 million barrel production cut introduced by the eight members in 2023 to an end. This includes an additional quota being phased in by the United Arab Emirates.

In early April, OPEC+ caused oil prices to fall to their lowest level in four years when it announced a sudden acceleration of its plan the current package of cuts was lifted while markets were suffering from the effects of Donald Trump's trade policies, which had slowed the global economy. Since then, OPEC+ has continued a series of significant monthly increases in oil production, accelerating in July. The main goal of Saudi Arabia, the leader of OPEC+, is to regain the market share that OPEC+ lost to competitors during years of production cuts.

United States. According to forecasts by the Energy Information Administration (EIA), oil production in the United States will reach a record 13.41 million barrels per day in 2025 thanks to increased borehole productivity, although lower oil prices will lead to a decline in production in 2026. The decline in production in 2026 to 13.28 million barrels per day will be the first drop in production since 2021 for the world's largest oil producer. According to the EIA, Brent crude oil prices will average $51 per barrel next year.

Canada. According to S&P Global Commodity Insights' forecast, production of so-called oil sands (sands with commercially significant oil content) in northern Alberta will reach a record annual average of 3.5 million barrels per day in 2025 (5% more than in 2024) and exceed 3.9 million barrels per day by 2030. Growth in production is driven by improvements in efficiency and optimisation, as well as favourable economic conditions.

Canada is the world's fourth largest oil producer, with about two-thirds of its 4.9 million barrels per day coming from the oil sands of northern Alberta.

South America. By 2030, oil production in this region is projected to grow by about a third, compared to a quarter in the Middle East and a tenth in North America.

Three South American countries stand out:

The first is Brazil. Consulting company Rystad Energy predicts that oil production in Brazil will grow by 10% this year and exceed 3.7 million barrels per day. On 4 August, British company BP announced the discovery of the Boomerang field in Brazil, the company's closest discovery in 25 years. Analysts consider the discovery of this field a positive sign for Brazil's oil prospects as a whole. Oil giants such as Chevron, Shell and TotalEnergies are expanding their operations in the country.

Petrobras, Brazil's state-owned oil company, is also investing in expanding exploration and production. In the second quarter of 2025, Petrobras increased oil production by 7.6% to 2.32 million barrels per day. The growth was made possible by the launch of new floating platforms (FPSOs), one of which began operating ahead of schedule.

The second is Guyana. Rystad Energy expects oil production in this country to grow by 12% this year to about 690,000 barrels per day, and to reach about 1.2 million barrels per day by 2030. The impact of oil on Guyana's economy is enormous. The country, with a population of about 820,000 people, is now the fastest growing economy in the world. Its GDP grew by more than 33% in 2023 and by more than 40% in 2024.

The key factor here is the giant Stabroek Block oil field, located about 200 km off the coast of Guyana. Four floating platforms (FPSOs) are currently operating at this field: Liza, Unity Gold, Payara Gold, and One Guyana, which began production ahead of schedule on 8 August at the Yellowtail development and is the largest FPSO at Stabroek Block with an initial average annual production of 250,000 barrels per day. The American company ExxonMobil is developing two more projects on the Stabroek Block – Uaru and Whiptail, which will be commissioned in early 2026 and early 2027, respectively. According to the company, the Uaru project will add approximately 250,000 barrels per day of production after its planned launch.

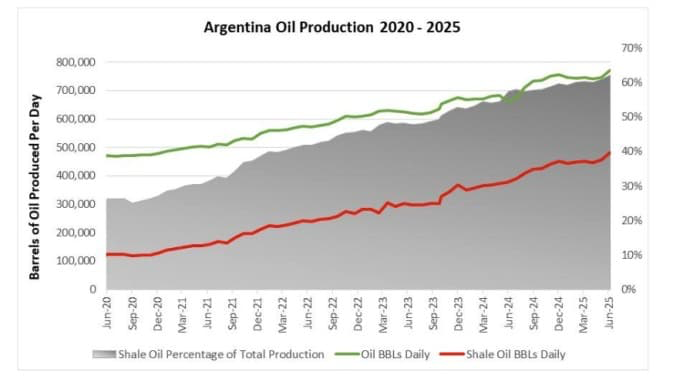

Third – Argentina. The oil sector of this country is currently developing fast under the leadership of President Javier Milei. The boom is being driven by Vaca Muerta, a shale region in the west of the country. In the first quarter of 2025, oil production there increased by 26% compared to the same period last year, reaching 253,000 barrels per day.

In June 2025, total oil production in Argentina averaged 771,888 barrels per day, of which more than 62% was shale oil. This is 3.32% more than in the previous month and a whopping 16.79% more than in the same period last year.

Libya. According to S&P Global Platts, in May 2025, crude oil production in Libya reached 1.23 million barrels per day, the highest figure in the last ten years. Compared to April, Libya increased production by 30,000 barrels per day in May.

Libya. According to S&P Global Platts, in May 2025, crude oil production in Libya reached 1.23 million barrels per day, the highest figure in the last ten years. Compared to April, Libya increased production by 30,000 barrels per day in May.

Russia is experiencing a complex set of problems that are gradually forcing the government to revise its budget parameters. Approximately one-third of the Russian federal budget is funded by oil and gas revenues, so the fall in world oil prices will increase its deficit.

According to preliminary data from the Russian Ministry of Finance, the budget deficit increased to 4.879 trillion roubles (2.2% of GDP) in January-July, exceeding the current annual plan of 3.792 trillion roubles (1.7% of GDP). At the same time, in July alone, the budget deficit amounted to 1.186 trillion roubles.

In July 2025, the Russian budget received 787 billion roubles in oil and gas revenues, which is 28% less than in the same period last year. This is the third month in a row that the decline has reached approximately 30%. In total, oil and gas revenues decreased by 18.5% year-on-year over seven months, amounting to 5.522 trillion roubles.

The reasons for the decline are lower global oil prices and a strong rouble.

According to the Foreign Intelligence Service of Ukraine, the average price of Urals crude oil fell by 18.4% to $60.37 per barrel. At the same time, the rouble has strengthened by 45% since the beginning of the year, from 113.71 to 81.25 per US dollar. Gas supplies to the EU fell by 50% to 9.93 billion cubic metres.

Despite this, federal budget expenditures are growing rapidly. In January-July, they increased by 20.8% compared to the same period last year, amounting to 25.194 trillion roubles. At the same time, total budget revenues grew by only 2.8%. As it is known, Russia's military spending in 2025 increased by a quarter – to 6.3% of GDP, which is the highest figure since the Cold War.

The Russian authorities have already adjusted the plan: instead of 10.94 trillion roubles in oil and gas revenues, only 8.32 trillion are expected. This will lead to further expenditures from the National Welfare Fund (NWF), whose liquid assets have already fallen by almost three times – to 4 trillion roubles. In response to the decline in revenues, the Russian government is reducing compensation to oil companies within the fuel damper.

According to the Ministry of Finance, in August, the budget may lose additional oil and gas revenues in the amount of 12.1 billion rubles. Between 7 August and 4 September, the Ministry of Finance will sell gold and foreign currency worth 0.3 billion roubles daily (a total of 6.2 billion roubles for the specified period).

Due to the budget deficit, Russia is forced to reduce one-time payments to new recruits in a number of regions. According to the Defence Intelligence of Ukraine, payments have decreased from 1.6 million to 1 million rubles in Bashkiria, from 3 million to 800,000 in the Belgorod region, from 3 million to 1.5 million rubles in the Nizhny Novgorod region, and from 3.1 to 1.9 million rubles in the Yamalo-Nenets district. At the same time, payments are increasing in a number of regions: for example, in Tatarstan, the bonus has been raised to 3.1 million rubles, and in the Ryazan region, they promise to pay an additional 1 million.

Controlled scenario – a budget deficit of 3-5 trillion rubles. However, such a deficit can only be controlled until 2025 – at the expense of remaining liquid reserves and a reduction in investment programmes. In 2026, such a deficit will already be a ‘risky scenario.’

Risky scenario – a deficit of 5-8 trillion rubles. Under this scenario, the Kremlin will be forced to significantly reduce the budget, primarily through substantial cuts in social payments. Investment programmes will mostly be frozen. The National Welfare Fund, as a liquid reserve, will be exhausted. The deficit will be covered by issuing expensive federal loan bonds (OFZ) and draining liquidity from banks through their forced buyout.

Critical scenario – a deficit of 8 to 11 trillion. All of the above will happen, but it will not be enough to resolve the situation – and therefore the only solution to avoid the collapse of the financial system will be a direct reduction in military spending. Therefore, a budget deficit of 8 trillion roubles could significantly affect the front due to cuts in military spending.

National Welfare Fund (NWF) – 4.13 trillion roubles. Last month, 1.29 trillion was transferred to it from all correspondent accounts. They're doing this because they need to cover a big deficit at the end of the year and avoid headlines about ‘depletion.’

Additional federal loan bonds (OFZ): no more than 1-2 trillion in addition to the 4.7 trillion included in the budget. But this will be critical, given that as for today, Russian banks already have a 1.25 trillion liquidity deficit and are expecting support from the Central Bank, rather than being forced to repurchase OFZs from the Ministry of Finance again.

Printing. The question is how much the financial system can absorb, given the banks' liquidity deficit and the fact that hidden printing has been actively taking place since October 2024. The money supply is critically large, but so far it has been hidden and absorbed by banks through bonds, but this mechanism cannot last forever, as the consequences are already evident – a liquidity deficit in banks.

Now, Russia has practically reached a budget deficit of 5 trillion roubles, and thus has effectively passed the stage of a ‘controlled scenario’. By the end of the year, Russia will have a deficit of 6-7 trillion roubles – meaning, it will be on the borderline between “risky” and ‘critical’.

A further decline in world oil prices will undermine the Russian budget. The situation could be even more dramatically affected by secondary US sanctions on Russia's trading partners who buy its energy resources. It would critically damage the Russian budget.

On 6 August, US President Donald Trump already imposed additional 25% tariffs on India for purchasing oil from Russia. Bloomberg reported that although the Indian government has not issued any official orders or recommendations to restrict purchases of Russian oil, the largest state-owned refineries — Indian Oil, Bharat Petroleum, and Hindustan Petroleum — have already excluded Russian oil with delivery in October from the list for the next procurement cycle. First and foremost, Indian state-owned refineries are refusing to make spot purchases of Russian oil.

The reason is not only the uncertainty surrounding Trump's tariffs, but also the EU's decision to completely abandon Indian petroleum products made from Russian oil by the end of the year. The vast majority of private refineries in India continue to purchase Russian oil, but in order to retain buyers, the Kremlin was forced to offer an additional fixed discount of $5 per barrel. It is off the price and does not take into account additional costs for insurance, logistics, and so on.

This brought the discount almost to mid-February levels, when Russia was forced to dump oil amid the effect of Biden's ‘farewell sanctions.’ This means a reduction in the Kremlin's net income from oil sales to India.

Firstly, even without a decision from the Indian government, traders will reduce their purchases of Russian oil due to EU sanctions (a stable factor) and uncertainty surrounding US decisions (an unstable factor). According to Kpler, Indian traders are interested in all available volumes of Middle-Eastern oil and are trying to ‘intercept’ it, but replacing 37% of their own market without significant losses is almost impossible.

Secondly, India is expected to agree to officially purchase bigger volume of American oil. It is noted that Indian traders have already begun to purchase more oil from the US.

Thirdly, the trend towards increasing discounts on Russian oil will continue, as the Kremlin traditionally takes its refineries out of service for repairs from August to October, which means that Russia will need to sell larger volumes of crude oil (rather than petroleum products), which means bigger discounts for buyers.

Therefore, it is expected that the discount on Russian oil purchased by India will continue to increase, but at the same time, volumes will continue to decline due to risks caused not only by Trump's policy, but also by the EU.

In statistical terms, this will start to be reflected at the end of September and in October, since oil supplies are booked in advance. In other words, India is initially receiving the volumes it booked in previous months, so the statistics do not yet fully reflect the impact of EU sanctions and Trump's actions.

RESURGAM EDITORIAL

You may be interested